Children enrich our lives, but they also cost money. In order to look to the future with financial confidence and self-determination, it is worth drawing up a detailed family budget. We will give you an overview of the additional costs you will have to expect when a new generation arrives.

Long-term budgeting protects against unpleasant surprises

Children cost money. Young families with low incomes in particular can quickly reach their limits financially when there are children. It is therefore worth drawing up a budget and comparing income and expenses.

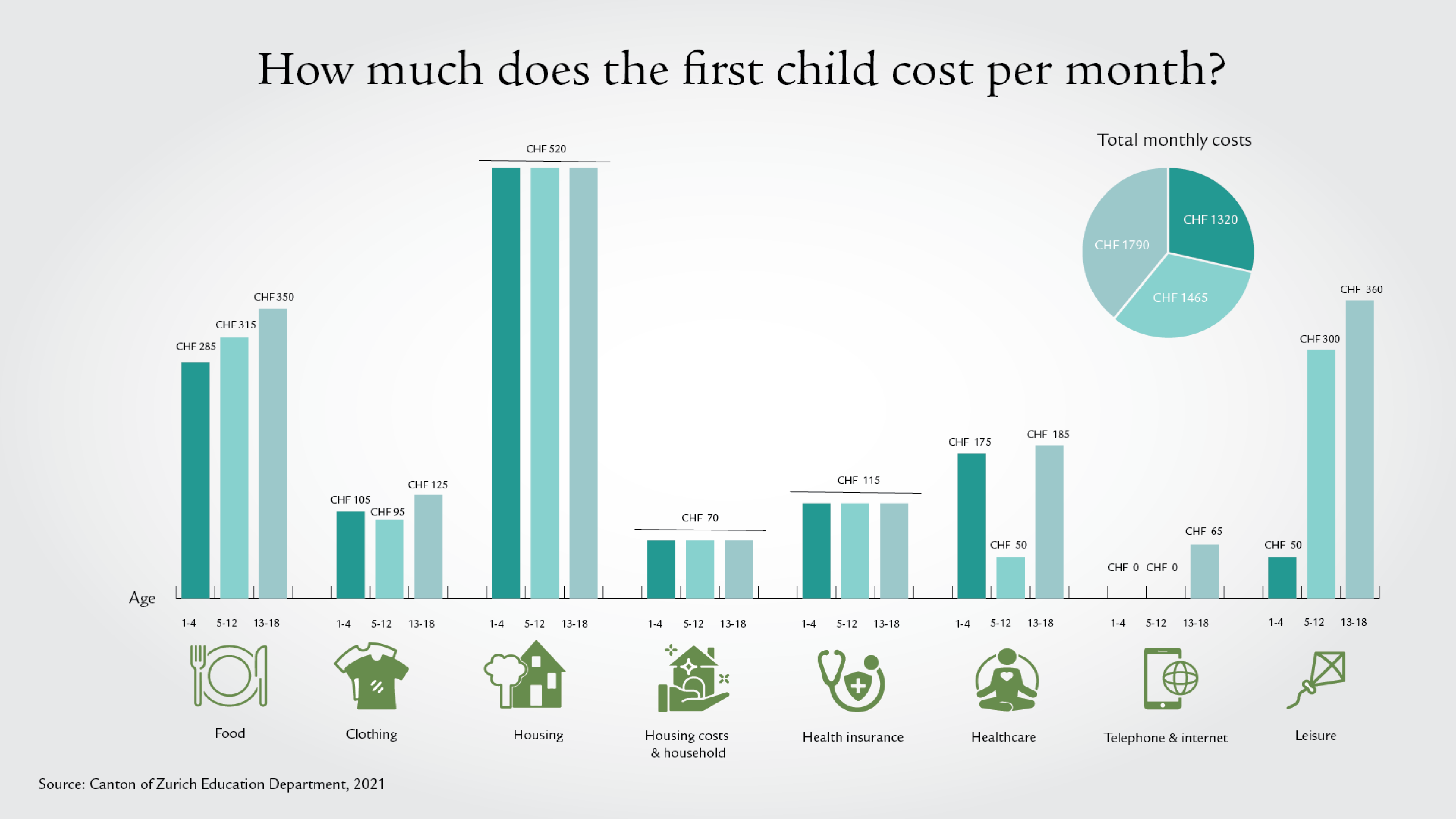

Infographic on monthly costs for children

How much does a child in Switzerland cost up to the age of 20?

According to a calculation by the Education Department of the Canton of Zurich, a child costs between 1300 and 1800 francs per month, or an average of 18 500 francs per year. Based on this calculation basis, a child costs CHF 370 000 up to their 20th birthday. Included in this calculation are only the direct costs for clothing, food, personal hygiene, accommodation, insurance, leisure time, public transport tickets and pocket money.

Each additional child is an extra financial burden, albeit not as much as the first child. According to the Education Department, the sum per child drops to between CHF 900 and CHF 1500 per month for three children. Those who create a sample budget need not be afraid of these figures but can look forward to the next generation and face the future with confidence

The additional child-related costs can be cushioned to a certain extent by means of tax reductions, child allowances and premium reductions. Indirect costs such as childcare expenses, expensive hobbies or cost-intensive gadgets such as a smartphone are not included in the above calculation. Furthermore, no shortfall in income, such as the reduced salary income due to part-time employment, is taken into account.

Indirect costs of part-time jobs

Level of employment: many parents work part-time and forgo part of their salary.

Future provisions: the lower part-time income leads to gaps in coverage in the 1st and 2nd pillars. These gaps are covered to some extent by child-rearing credits in the first pillar.

Career: with part-time jobs, career progression is often not as fast as with a full-time job. This could lead to lower future income as well.

How much does a baby cost?

You can expect an additional cost of around 300 to 450 francs per month for a baby (source: Budgetberatung Schweiz, 2023). This money is used for nappies, clothes, food, household costs, insurance and higher ancillary costs. If you need childcare, it costs extra.

Budget calculator

Use the budget calculator to calculate your monthly income and expenses so you can plan future financial expenses with children.

How much does childcare cost in Switzerland?

A daycare centre costs around CHF 130 per child per day (source: swissinfo.ch). If a family needs full-time childcare, the figure rises to CHF 2600 at 20 working days a month.

Parents with lower wages receive subsidies. The amount of the subsidy depends on the income of the parents and the canton of residence.

Which age is the most expensive?

Children are adventurous, and as they age, their leisure activities become more demanding. A trip to the zoo, a visit to the cinema or a weekend in the mountains cost money. Holidays also become more expensive the older the child gets. There are also expenses for school camps, hobbies and pocket money.

The most expensive are children aged 13-18: depending on which educational path they choose, they can cost CHF 650-1790 per month. It becomes even more expensive if they want to study, because the monthly maintenance including shared accommodation and train tickets costs a lot. Parents with a child completing an apprenticeship and earning the accompanying salary have an easier time.

Obtain advice now

Our advisors can help you find the right investment funds for your family savings plan.

Part-time calculator

Would you like to enjoy family life to the full and work part-time? Find out quickly and easily what impact the reduced level of employment would have on your budget and on childcare.

Image source: iStock

Data source: Pro Familia Switzerland: This is how much a child costs in Switzerland, www.zh.ch/ajb (2021)