Find the best mortgage with the best interest rate easily and quickly: as an independent mortgage broker, we can find suitable offers for you from Swiss Life, Credit Suisse, UBS, BEKB, Walliser Kantonalbank and other premium partners.

What does “best interest rate” mean?

The lowest interest rate is not always the best one.

Various factors play a role in determining the best interest conditions for your mortgage:

Assets and financial flexibility

If you have sufficient funds of your own and thus considerable financial scope, you are more flexible when it comes to mortgages. The following applies here: the higher your own assets and income, the lower the loan-to-value ratio. This in turn has a positive impact on affordability, which results in a better interest rate for your mortgage.

Value of the property

You can get better mortgage conditions for a property with far more value compared to its quality. Which factors influence the value of the property? Examples include location, plot size, building condition, tax rate and extension options.

Term and time of conclusion

The amount of interest also depends on the term and the time of conclusion. This is due to constant fluctuations in interest rates, which can deviate significantly upwards or downwards within a few days.

Risk appetite in the event of interest rate fluctuations

Interest rates are subject to fluctuations that are affected by the type and amount of the mortgage. Borrowers willing to incur risk opt for a mortgage that adjusts to interest rates, such as the SARON mortgage or a variable mortgage. Risk-averse borrowers should choose a fixed-rate mortgage.

Benefit from Swiss Life as an independent mortgage broker and secure the best interest rate: we help you find the ideal time to fix the interest rate. You can choose the right mortgage from Swiss Life’s financing options and those of other providers in a self-determined manner.

Take out a new mortgage

With the mortgage check, you can receive mortgage offers from different providers for different terms in just a few clicks.

Replace existing mortgage

Our virtual assistant (ViBe) will help you clarify your initial questions about replacing a mortgage and obtain new offers for your existing mortgage. You receive mortgage offers from different providers for different durations.

The best mortgage with Swiss Life

Your advantages with Swiss Life as an independent mortgage broker:

- Independent offers: We make offers from different providers comparable for you – for the perfect overview. You decide yourself from which provider we should obtain offers and where the financing is to take place.

- Save time when researching: We can show you many mortgage offers in parallel – in person at your home or online via video call.

- Preferential conditions for mortgage offers: We can often exclusively negotiate better conditions than you would otherwise receive.

- Real-time calculation of interest conditions: When the general environment changes, new conditions will become available immediately.

- Self-determined and protected: We ensure that you can continue to finance your home in the event of financial misfortune.

Make an appointment for a consultation

Our experts at Swiss Life and Swiss Life Select would be happy to advise you at a location of your choice or online by video.

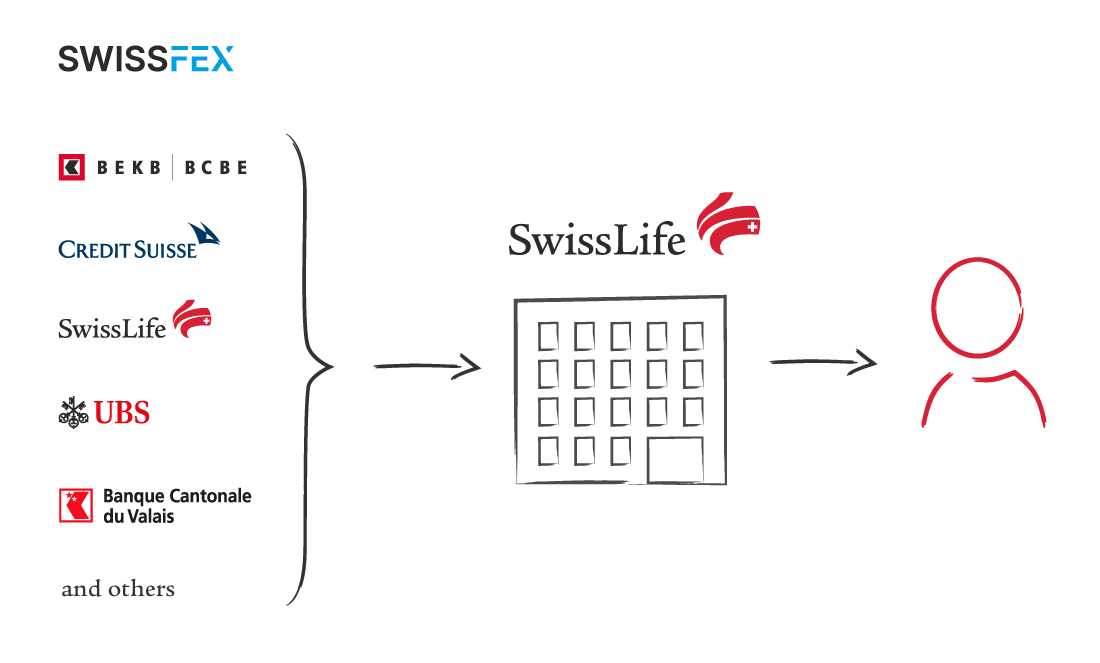

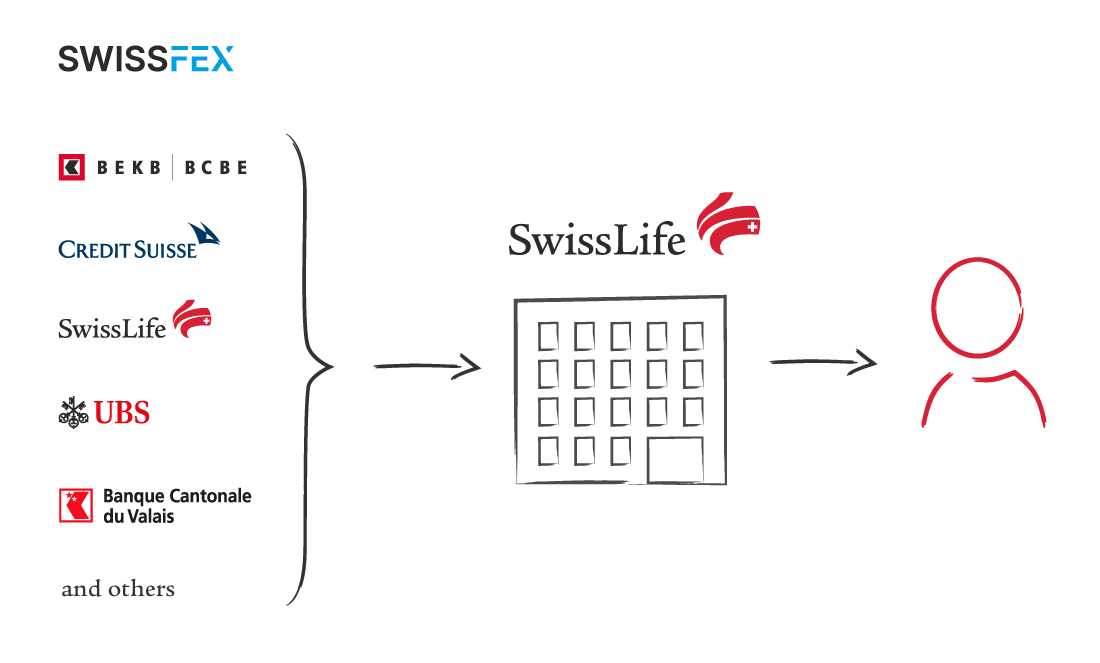

Partner for mortgage offers

SwissFEX’s financing partners include major and regional banks, insurance companies, pension funds and investment funds. The partner network continually adapts to developments in the mortgage market. This enables you to choose from the providers and offers that best suit your personal situation and obtain the best interest rate.

For the best interest rate: we collaborate with these partners: