The mortgage check enables you to receive initial mortgage offers from different providers for different terms in real time and in just a few clicks.

The 'Best Offer’ is determined on the basis of current interest rate trends and takes into account both Saron and fixed-rate mortgages.

How the interest rate on your mortgage is calculated

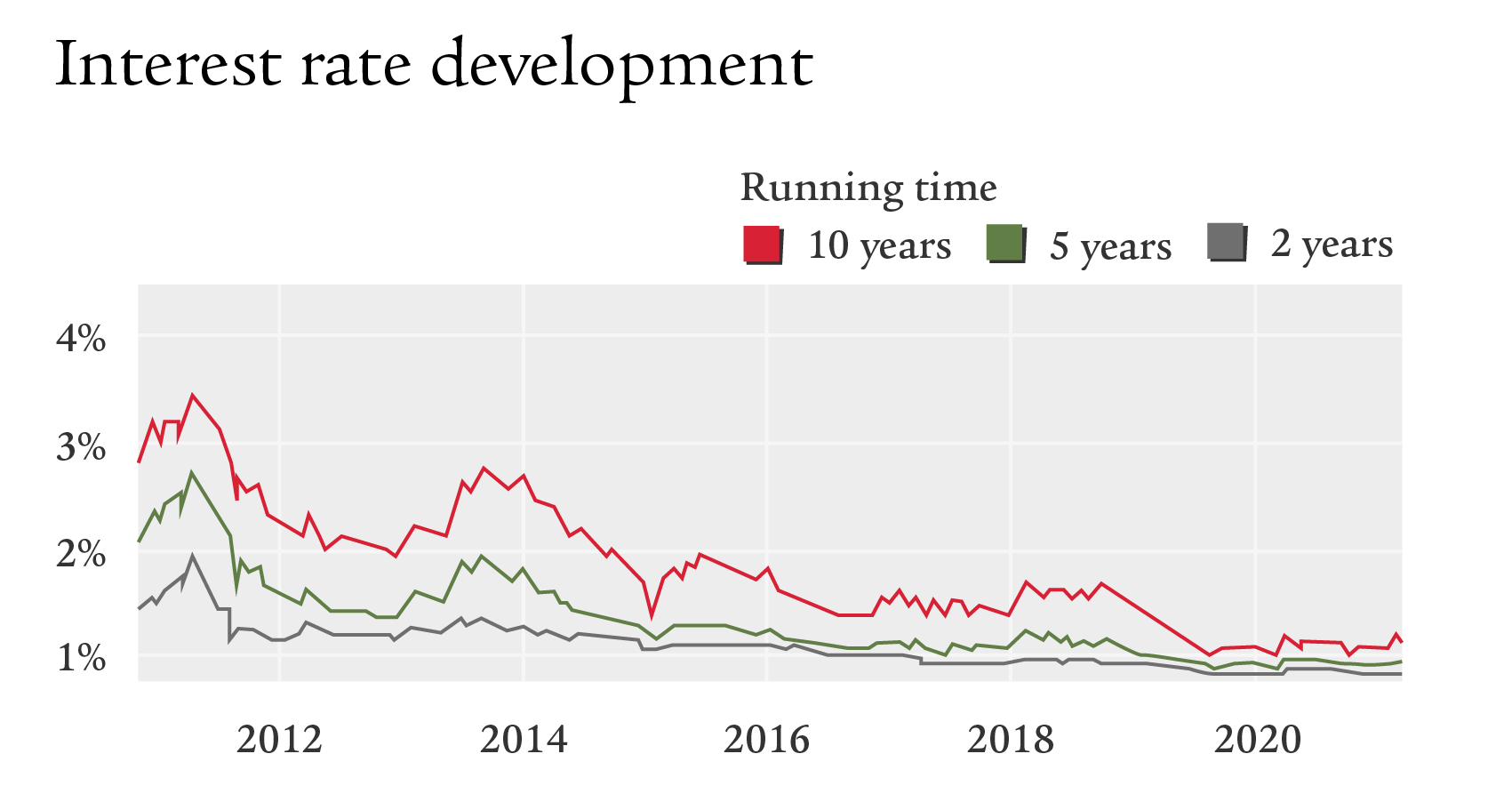

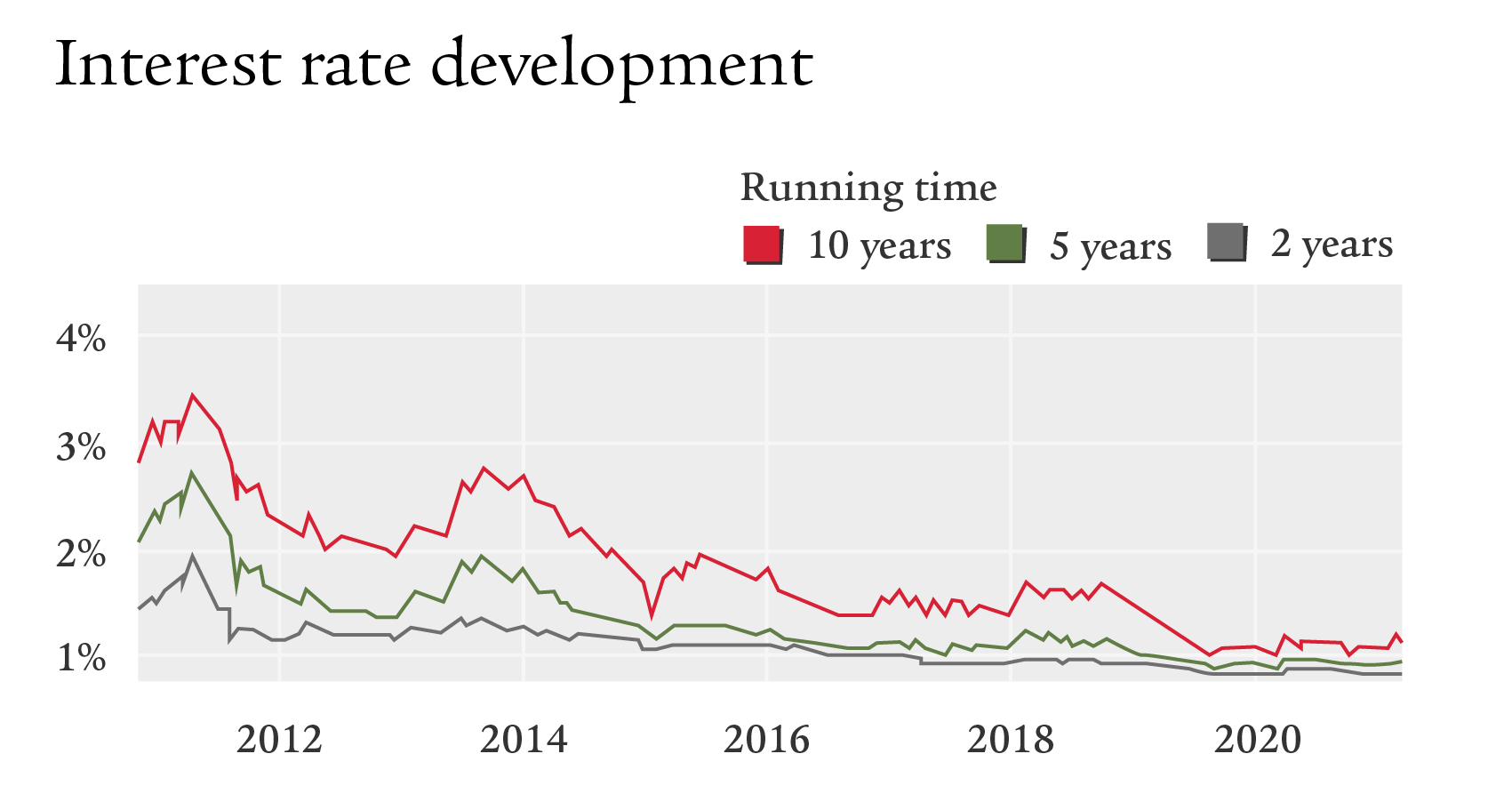

The value of the property, your assets and the affordability of your mortgage play a major role in determining the specific interest conditions on your mortgage. You can expect better conditions for a property with a better value than its quality, a solid income and sufficient available assets. However, the amount of interest also depends on the term and timing of the transaction. This is due to constant fluctuations in interest rates. These can deviate significantly upwards or downwards within a few days.

And you can benefit from Swiss Life as an independent mortgage broker. We support you in finding the ideal time for fixing the interest rate. You can choose the right mortgage from Swiss Life’s financing options and those of other providers in a self-determined manner.

This is how mortgage interest rates in Switzerland have developed over the past ten years:

How we can help you find the right financing with the best interest rate

- We can offer you customised budget, pension and financial advice to help you realise your dream of owning your own home more quickly.

- We show you how you can accumulate your equity capital in a tax-optimised manner over the long term.

- We take a comprehensive look at your personal situation and tailor a financing concept for you.

- Thanks to the SwissFEX mortgage platform, we can show you a wide range of offers from different providers. Suitable offers are compared transparently and in real time.

- We make it possible for you to access mortgages on preferential terms that you would not otherwise have access to.