How much will my pension be? There is no general answer to this question. However, you can already check whether you have any pension gaps. This means not having enough money to finance your spending in a self-determined manner when you reach retirement age. We will show you how to calculate pension gaps and what you can do to close them.

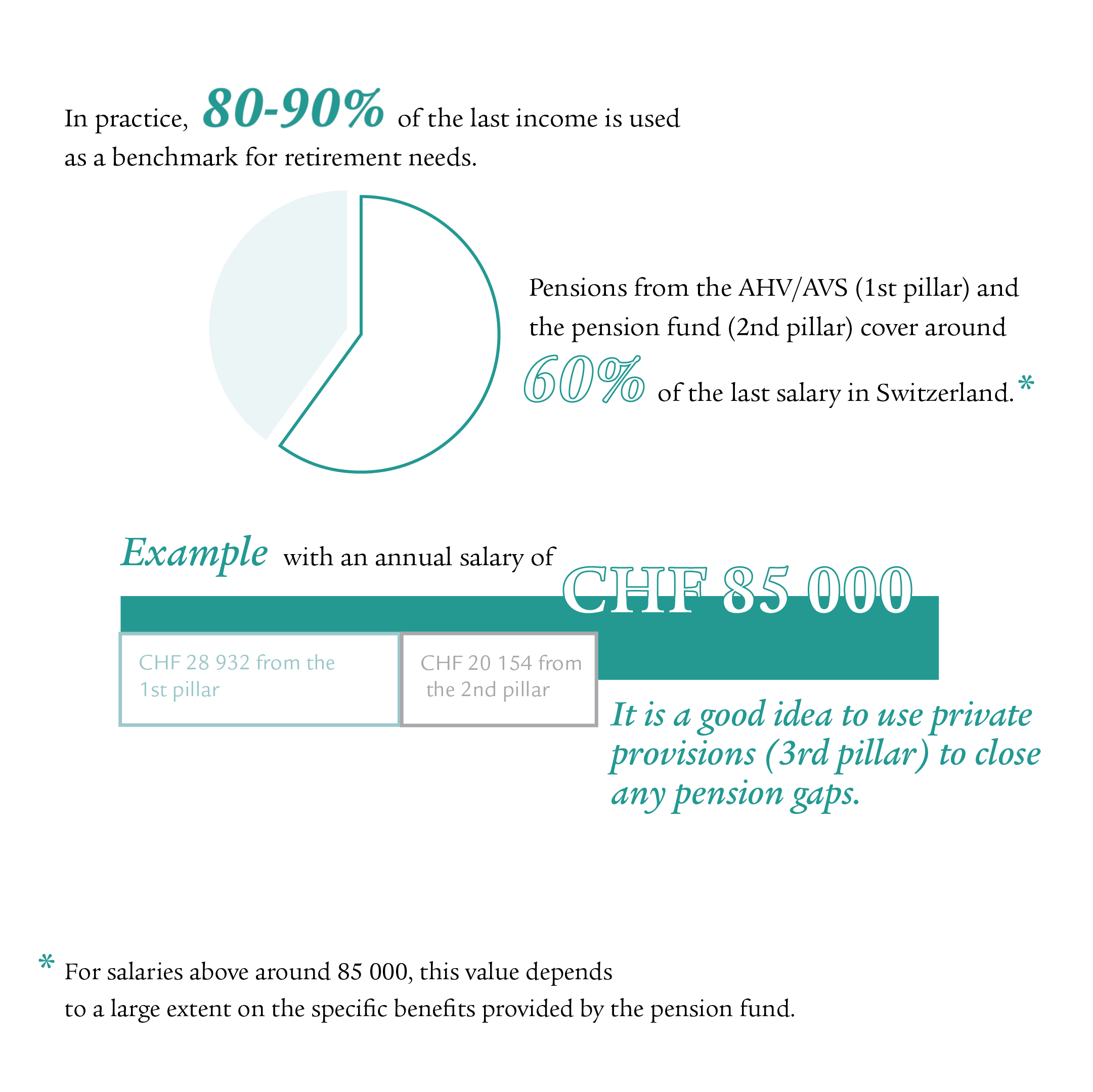

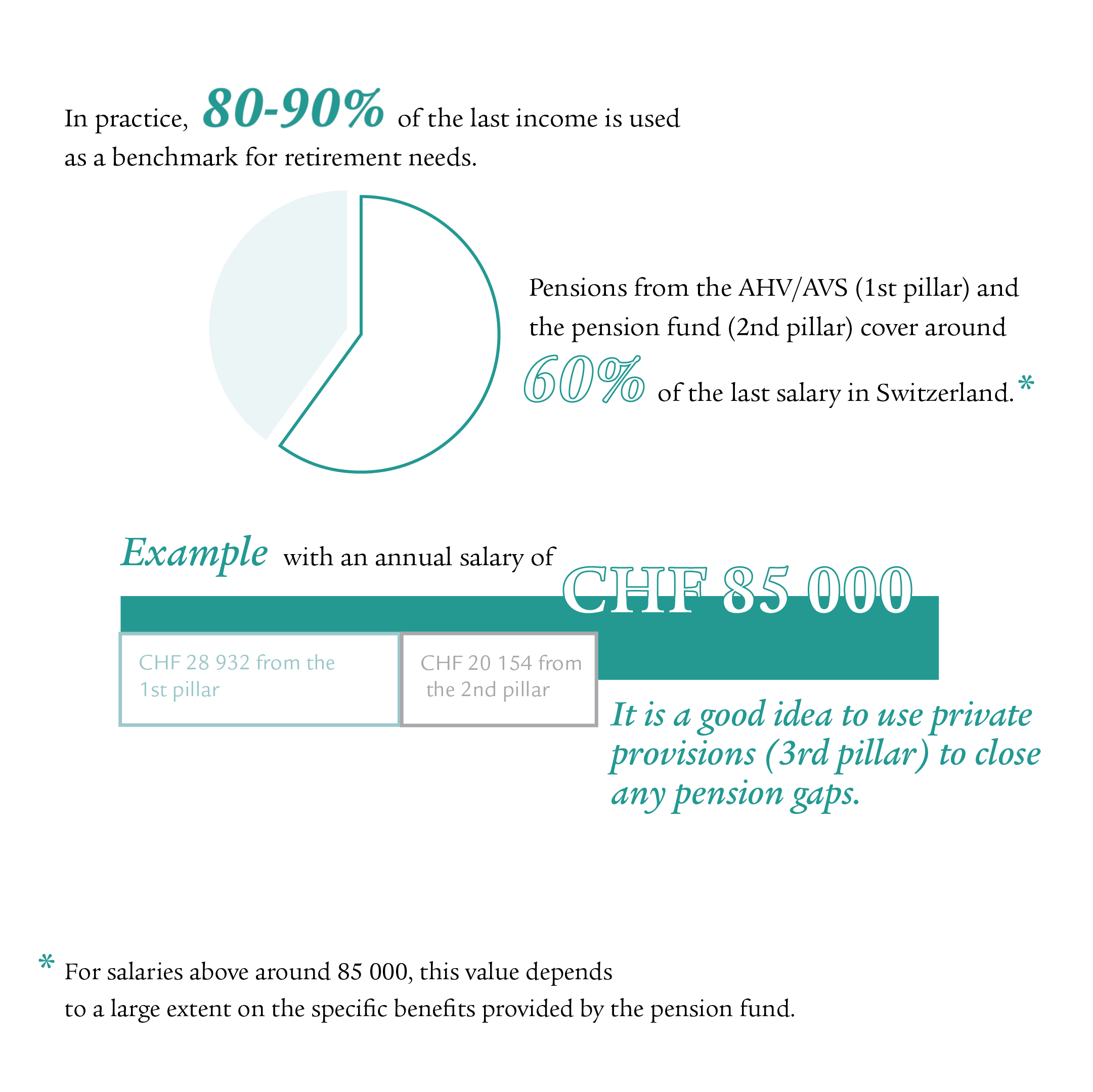

When you reach retirement age, you can expect an income of around 60% of what you were most recently earning. This income is made up of benefits from your 1st and 2nd pillar pensions. According to expert opinions, you will need 80 to 90% of your last income in retirement, which means that there is a shortfall of around 20 to 30%. In addition, many people do not reach the projected 60% from the 1st and 2nd pillars, as they have gaps in their AHV/AVS or pension fund. It is therefore advisable to identify any gaps early on and close them with private provisions.

1. What is a pension gap?

A pension gap occurs if your financial needs in retirement exceed the income available from the three pillars.

As a rule, AHV/AVS pensions (1st pillar) and your pension fund (2nd pillar) cover about 60% of your last salary. The resulting shortfall can be reduced through private provisions. In practice, 80 to 90% of your last income is used as the benchmark for what you will need in retirement.

Please note: this example calculation is based on an assumed annual salary of CHF 85 000; the second pillar amount of CHF 20 154 is an assumption under the BVG/LPP and depends on the specific pension fund solution.

2. Do I have a pension gap?

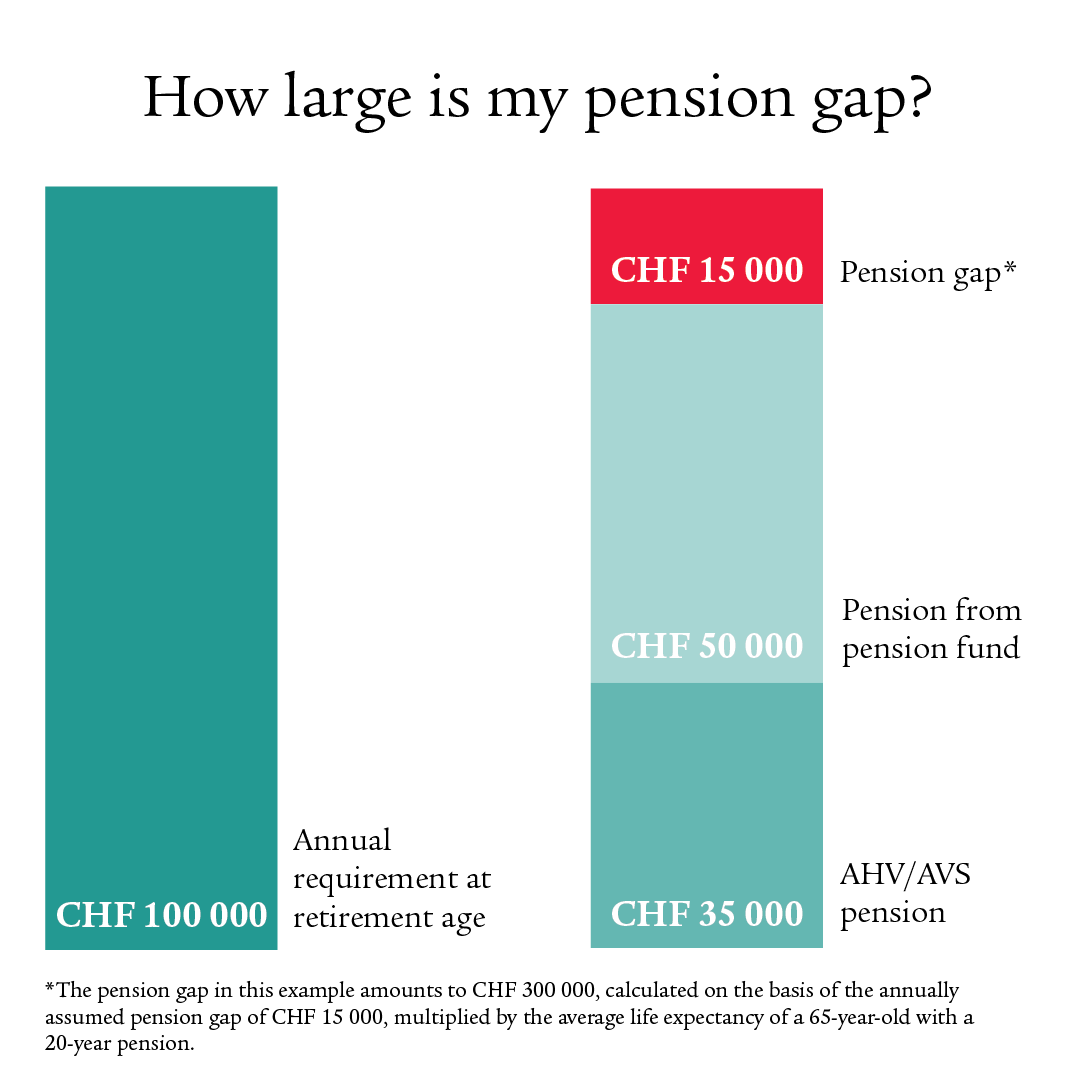

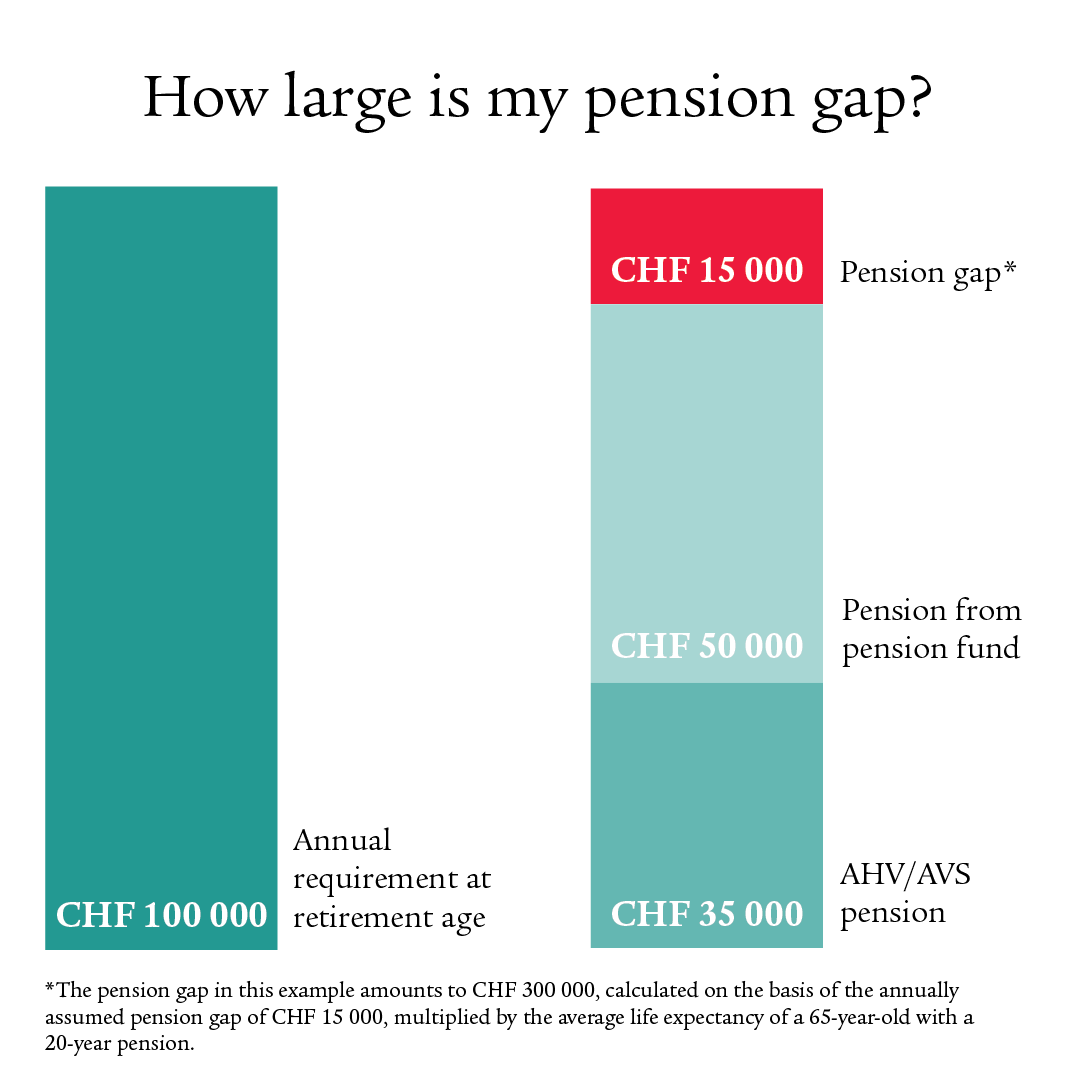

A pension gap is calculated by adding together the projected annual pensions from the 1st and 2nd pillars and comparing this amount to your estimated annual requirement. You can order a personal statement from your cantonal AHV/AVS administration office to find out your AHV/AVS 1st pillar pension. Your personal pension certificate shows how much your 2nd pillar pension will be.

According to experts, 80 to 90% of your last income is used as the benchmark for what you will need in retirement.

To calculate the total pension, multiply the difference between the amount you will need in retirement and your projected annual pension by 20. The number 20 is calculated on the basis of the assumed average life expectancy of 85 years (at retirement age 65).

Your 3rd pillar savings are then deducted from this pension gap. You should use the resulting amount as a savings target for closing the pension gap.

Please note: this calculation is based on the assumption that the annual requirement at retirement age is around CHF 100 000.

3. How does a pension gap arise?

The following situations or circumstances can lead to pension or contribution gaps:

- Interruption of employment

- Unpaid housework and care work

- Part-time work

- Missing contribution years due to longer trips/stays abroad without paying AHV/AVS contributions

- Early retirement

- Missing contribution years for people moving to Switzerland who were not part of the Swiss pension system when they started working

- Divorce

- Reduction of conversion rate

- High salary with an uninsured supplementary portion

Note with regard to 2nd pillar mandatory benefits

Check whether your salary is fully insured. By law, salaries up to CHF 88 200 are insured for both AHV/AVS and occupational provisions (mandatory portion). If you earn more, you should make sure that not only the mandatory salary is insured.

Example: you earn CHF 100 000 a year. Make sure that the full sum of CHF 100 000 is insured in your occupational provisions instead of just CHF 88 200. Sometimes this is already insured by your employer, but this is not always the case.

4. How can I close any pension gaps?

The most important thing is to be aware that you have a pension gap.

There are various options for closing pension gaps. On the one hand, it is advisable to continually pay in to your Pillar 3a. You can also make voluntary purchases in your pension fund. Both of these payments are tax-privileged.

In addition, an individually determined savings plan in the form of a pillar 3b can further reduce or close any pension gaps.

5. How can I check whether my contributions have been transferred in full to the 1st pillar?

You can order a statement for your individual account from your AHV/AVS administration office.

You can do so via the following link: Statement of individual account | Leaflets & forms | AHV/IV information office (ahv-iv.ch)

In the event of errors or inconsistencies on the account statement you receive, you must respond within 30 days, otherwise the statement will be deemed to have been confirmed as correct. If there are contribution gaps from more than five years ago, it is no longer to make supplementary payments and your pension will be reduced for life.

Set up pillar 3a now

Obtain free pillar 3a advice with no strings attached.

Questions?

Our experts would be happy to help you further and advise you on any questions relating to your retirement.