A burglary, water damage in your living room or a storm that smashes your balcony furniture into a thousand pieces. There are countless objects in your home that can be damaged. Household contents insurance, adapted to your needs for a self-determined life, protects you in the event of a claim.

The average home in Europe has 10 000 objects in it. From a wardrobe or sofa to clothing or jewellery to everyday objects such as cutlery, glasses or an electric toothbrush. A household contains a lot of objects, and each individual object has a value. Add them all up and it can quickly become very expensive if an unfortunate event occurs and damages or destroys the household.

We have summarised the key points regarding household contents insurance:

Household contents insurance explained simply

What does household contents insurance cover?

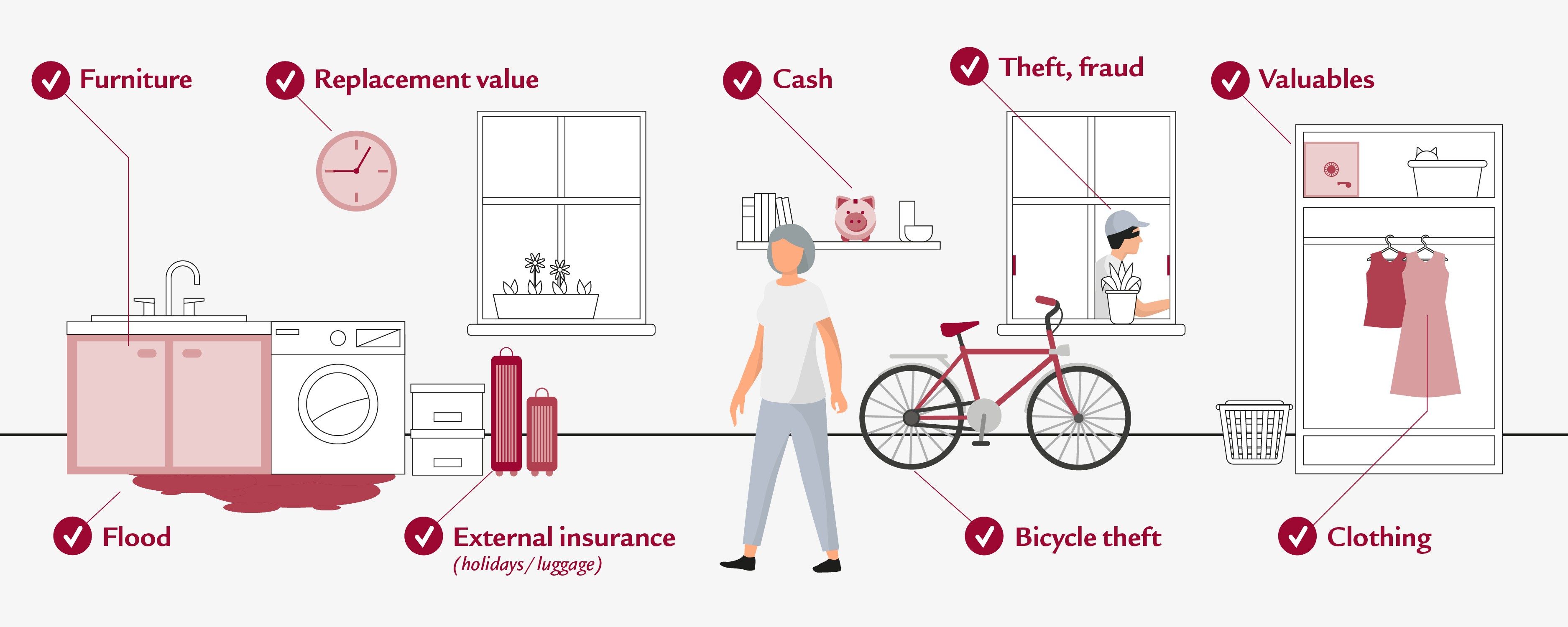

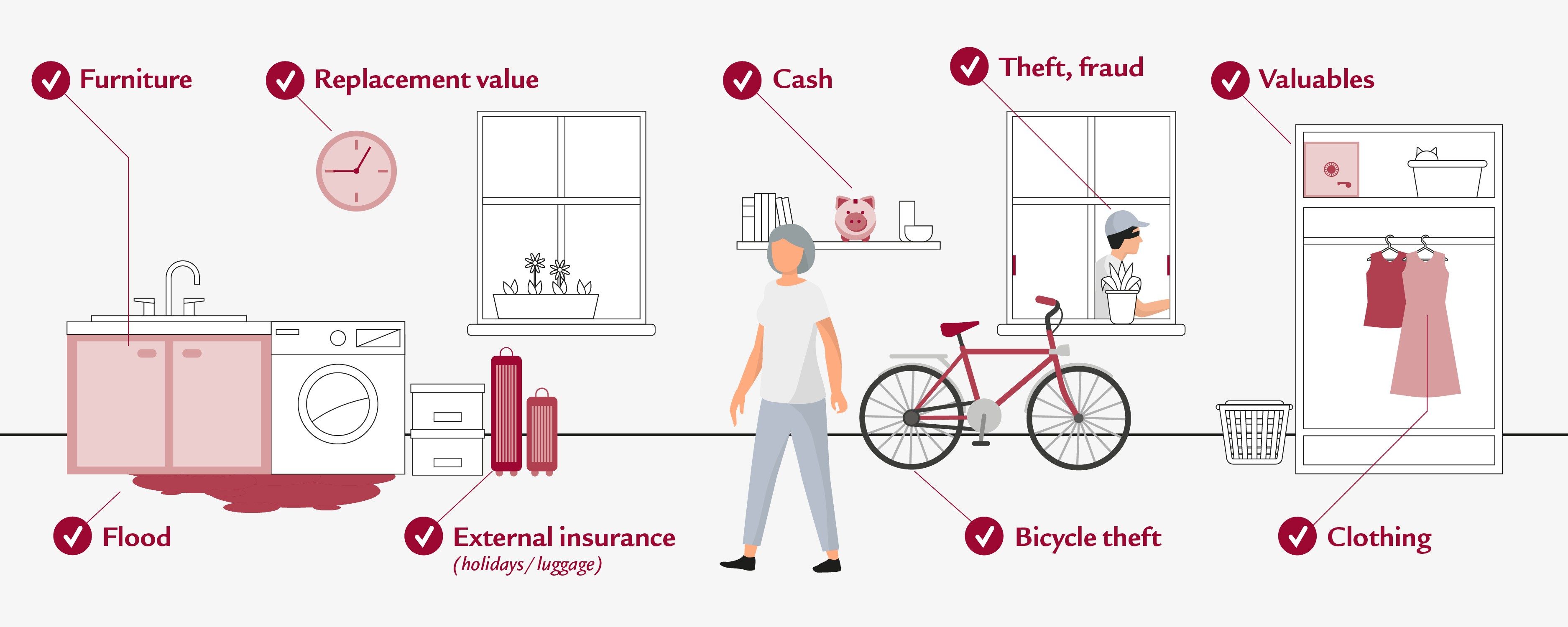

Household contents insurance covers damage caused by fire, water, storms or hail as well as burglary, robbery and vandalism following a break-in. The insurance covers all household contents and provides a payment to cover the cost of replacing the objects. Supplemental benefits can be added as well. For example in the event of simple theft outside the home or the loss of luggage while travelling.

Who should conclude household contents insurance?

Household contents insurance is not mandatory in Switzerland. Nevertheless, both tenants and owners are advised to insure their household contents. In the event of an unforeseen event that partially or completely destroys your household contents, you won't receive compensation for the value of the objects without household contents insurance. This can quickly become very expensive in the event of a claim.

Does household contents insurance pay compensation even if the policyholder is responsible for the damage?

Depending on the insurance package that is concluded, damage caused by policyholder or by a member of the household may also be covered. When concluding your household contents insurance policy, make sure this clause is included.

Such clauses cover unintentional damage, but not intentional actions. For example, if you accidentally sit on your glasses and break them. Or if you lose your wedding ring while swimming.

Where can I conclude household contents insurance?

Nearly all major insurers offer household contents insurance as part of their benefits. Optionally, you can conclude the insurance as part of a package, together with liability insurance. If you own a property, you can expand the package to include building insurance.

How much is household contents insurance?

The cost of household contents insurance depends on a number of factors. This includes the value of your household contents, the size of your apartment or house and the quality of your furnishings. Household contents insurance costs between CHF 150 and CHF 300 per year on average.

What is the retention for household contents insurance?

The retention is the amount you have to pay in the event of a loss. This amount varies. Depending on which insurance you opt for, it can be between CHF 200 and CHF 500.

How do I assess the value of my household contents?

If you want to calculate the precise value, you can conduct an inventory to add up the value of your household contents. To do so, make a list all of the items in your household, including their value. It is important to specify the current replacement value of the items. If you add them all together, you'll get the sum that should be insured.

Alternatively, you can also estimate the value, because making an inventory can be very time-consuming. First, make an estimate of the value of your household contents in general. Distinguish between simple, average and high-quality household contents. For example, designer furniture, designer clothing and expensive technical equipment should be placed in the high-quality category. It also indicates how many people live in the household, with children up to age 14 counting as half people. Finally, specify the size of the household and how many rooms it has.

Your insurance advisor will assist you in the calculation and help you determine the value.

For tech enthusiasts

Laptops, headphones and tablets are also part of the inventory and will be covered in the event of damage.

For fashionistas

Household contents also include shoes, dresses and accessories such as bags and scarves.

For sports lovers

Who lead a self-determined life: surfboards and ski equipment can also be insured.

For bookworms

Who live a self-determined life in literature: All books are also insured and compensation paid for them in the event they are damaged.

Make an appointment for a consultation

Would you like to conclude household contents insurance, or do you have questions? We would be pleased to provide you with information. Personal and non-binding – for a self-determined life.

Swiss Life Home in One

Swiss Life Home In One offers you contents, liability and building insurance. Three types of cover in one contract – and you'll always be optimally insured in and outside your home.

Image source: Unsplash, Josh Hemsley, Katja Rooke