The partially revised Swiss inheritance law has been in force since January 2023. The new provisions will enable you to decide in a more flexible and self-determined manner who is to receive how much of your estate. You will be able to dispose of a larger portion of your estate at your own discretion. New features include a reduction in the compulsory portions for descendants and discontinuation of the compulsory portion for parents. Swiss Life gives you an up-to-date overview and explains what to keep in mind in your inheritance and succession planning.

Key changes at a glance

- Heirs will only be entitled to 50% of their statutory inheritance as a compulsory portion, down from 75% previously.

- The compulsory portion of the parents, which was previously 50% of their statutory inheritance, will be discontinued.

- Pillar 3a assets will not be part of the estate

- There will be a ban on gifts when a contract of inheritance is concluded

- Married couples undergoing divorce proceedings will be able to exclude each other from the inheritance before the divorce decree comes into effect

What's staying the same?

The hereditary succession will remain unchanged

If the testator does not leave a will or contract of inheritance, the estate will be distributed according to the hereditary succession. The order of succession is based on kinship (including adoption), with close relatives excluding more distant ones. As long as the testator leaves behind descendants, these will exclude all other relatives. In addition, the surviving spouse or registered partner will always inherit.

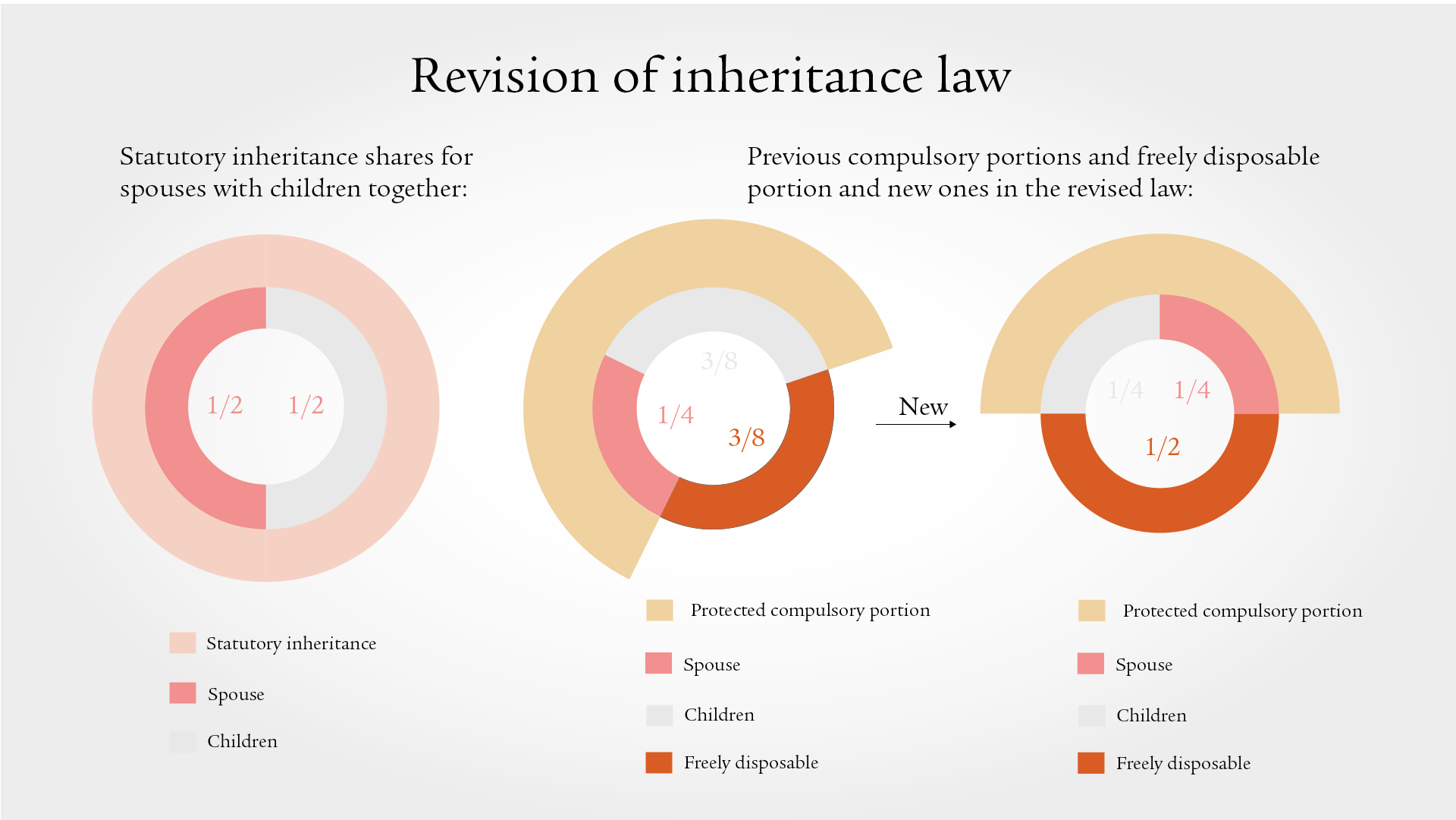

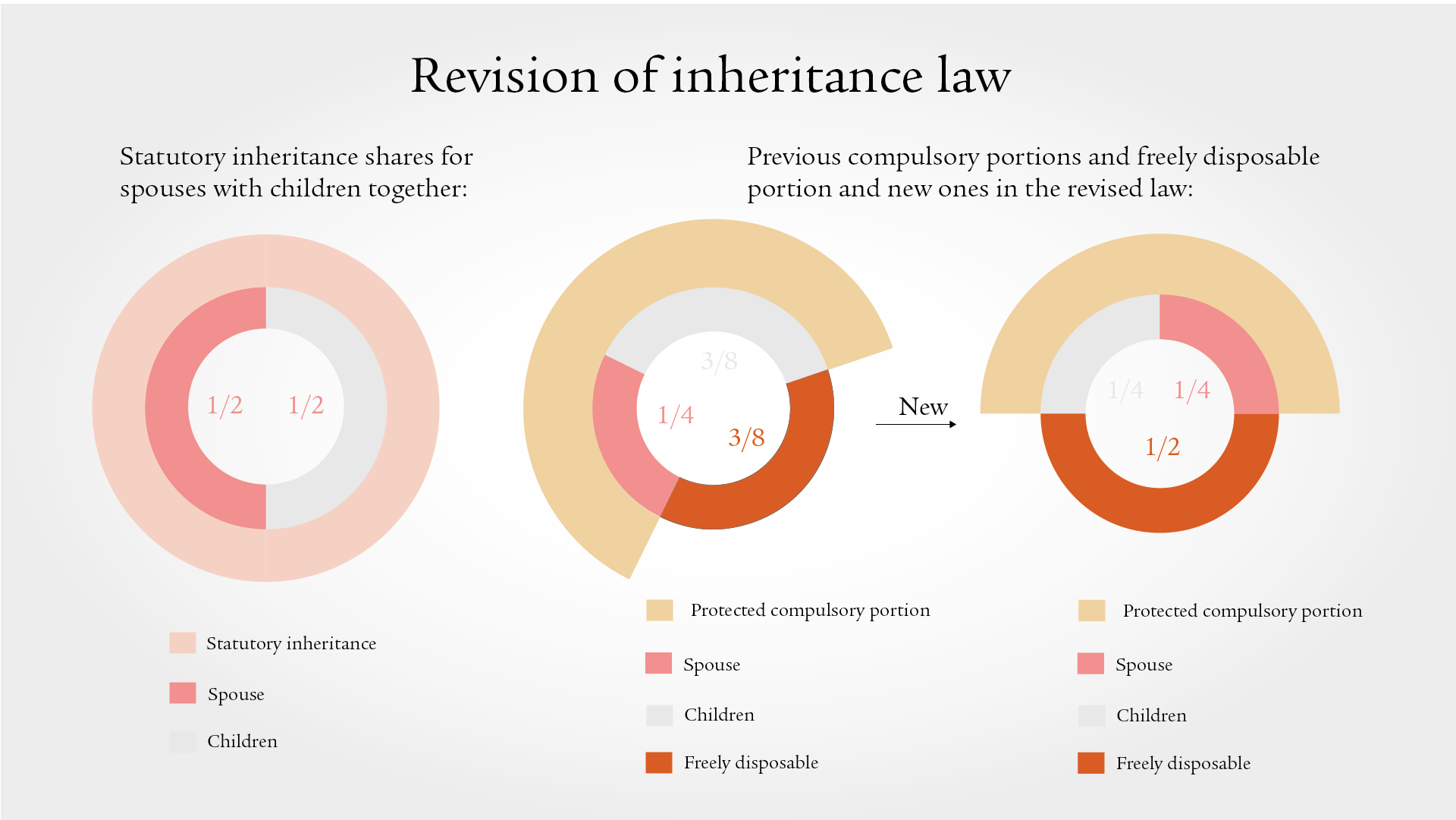

The statutory inheritances will remain as follows

The testator is survived by

- descendants only: 100%

- spouses (50%) and descendants (50%)

- spouse (75%) and parental heirs, as parents, siblings or nephews and nieces (25%)

- spouse (100%) and grandparental heirs as grandparents or uncles, aunts and cousins (0%)

The spouse’s compulsory portion will remain at 50% of the statutory inheritance.

What is changing?

Compulsory portions

Self-determined order of succession

With a will (unilateral decision), you can limit heirs protected by a compulsory portion to the compulsory portion and (additionally) favour others.

Compulsory portion of descendants

If you are survived by a spouse and descendants, the spouse’s compulsory portion will remain at 50% of the statutory inheritance, i.e. 25% of the entire estate. The compulsory portion of descendants will now also amount to 50% of the statutory inheritance, i.e. 25% of the entire estate. Under the revised provisions for the compulsory portions you will now be able to dispose of 50% of your estate in a self-determined manner, be this in favour of individual legal heirs (e.g. spouse) or third parties. Until now, the so-called “freely disposable portion” in the abovementioned family constellation only amounted to 37.5%.

Compulsory portion of parents

From 2023, the existing compulsory portion for parents will no longer apply. If you are survived by parents but no descendants, you will be able to exclude the parents from the hereditary succession and, for example, designate your spouse or life partner as full beneficiary (sole heir).

Other changes

Clarity on pillar 3a

Until now it has been unclear whether benefits from private tax-qualified provisions (pillar 3a) form part of the estate or are outside the rules of inheritance. The law now makes it unequivocally clear that pillar 3a assets (insurance and bank foundation) are to be paid directly to the beneficiary(ies).

However, the benefits are taken into account in the calculation of the compulsory portion up to the amount of the surrender value (insurance) or lump sum paid out (bank solution). This also applies to beneficiaries under pillar 3b insurance products with a surrender option.

Gift ban on conclusion of inheritance contracts

Once a contract of inheritance has been concluded, future gifts, with the exception of occasional gifts, may be contested by the contracting parties if such gift options are not expressly provided for in the contract. This will also apply to existing inheritance contracts.

Married couples in divorce proceedings

There is an important change in the case of married couples undergoing divorce proceedings. Under previous law, inheritance and compulsory portion entitlements only lapsed once the divorce decree entered into force. Under certain conditions, protection of the compulsory portion can now already be lifted during divorce proceedings. Spouses in divorce proceedings can therefore use a last will and testament to exclude each other from the order of succession.

Effects

The revised inheritance law takes greater account of the many different forms of living prevailing today (such as patchwork families and common-law partnerships). The reduction in the compulsory portions will give testators greater discretion in bequeathing their estate.

Act now

The time of death and not the time of creation of the will or contract of professional inheritance is decisive for determining the applicable law.

Review your existing wills or contracts of inheritance to avoid problems of interpretation.

Adjustments may be necessary.

You should pay attention to the following:

- If heirs are limited to the compulsory portion, should this apply according to the new provisions or should the existing portions continue to apply?

Examples:

You are married and have two children together whom you have limited to the compulsory portion in favour of your spouse. The spouse would now receive 3/4 of the estate and the two children 1/8 each.

You are widowed and have two children of your own whom you have limited to the compulsory portion in favour of your stepchild. Previously, the two children would each have received 3/8 of the estate and the stepchild 2/8. Under the new law, the two children would each receive 1/4 of the estate and the stepchild 1/2. If you do not want this to happen, your existing wills need to be adjusted.

- Do you wish to favour other/additional persons owing to the reduction in compulsory portions (descendants) and/or discontinuation of compulsory portions (parents) and the higher freely disposable portions resulting from this?

- Would you like to be able to allocate assets to third parties when concluding contracts of inheritance? If so, to whom and to what extent?

- Are divorce proceedings ongoing or foreseeable? Do you wish to exclude your current spouse as heir?

Make an appointment for a consultation

We would be pleased to provide you with more information – in a personal and non-binding consultation. We would also be happy to advise you by video instead of in the General Agency or at your home.

.jpg)