The Swiss electorate adopted the AHV 21 reform on 25 September 2022, which enters into force on 1 January 2024.

The AHV 21 reform

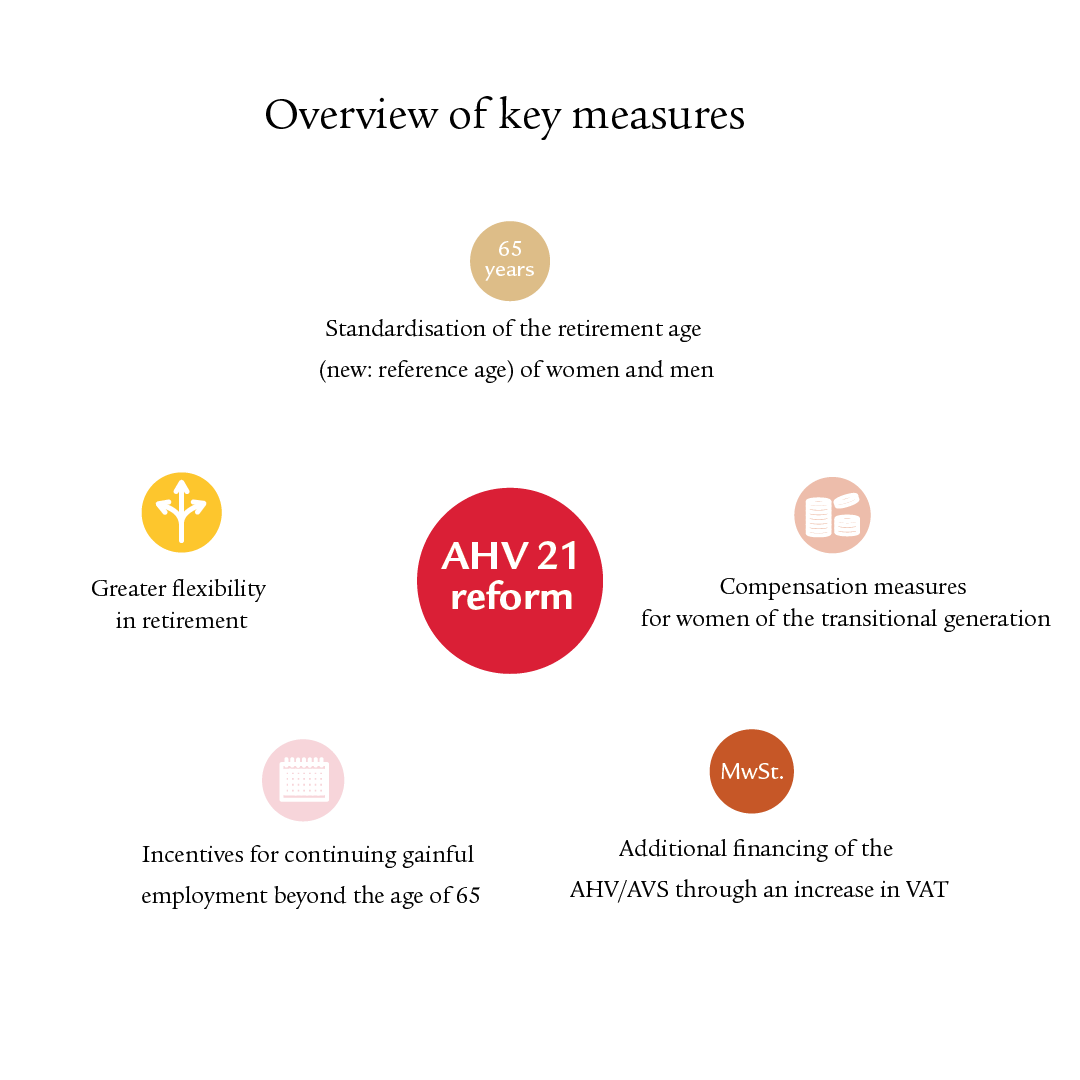

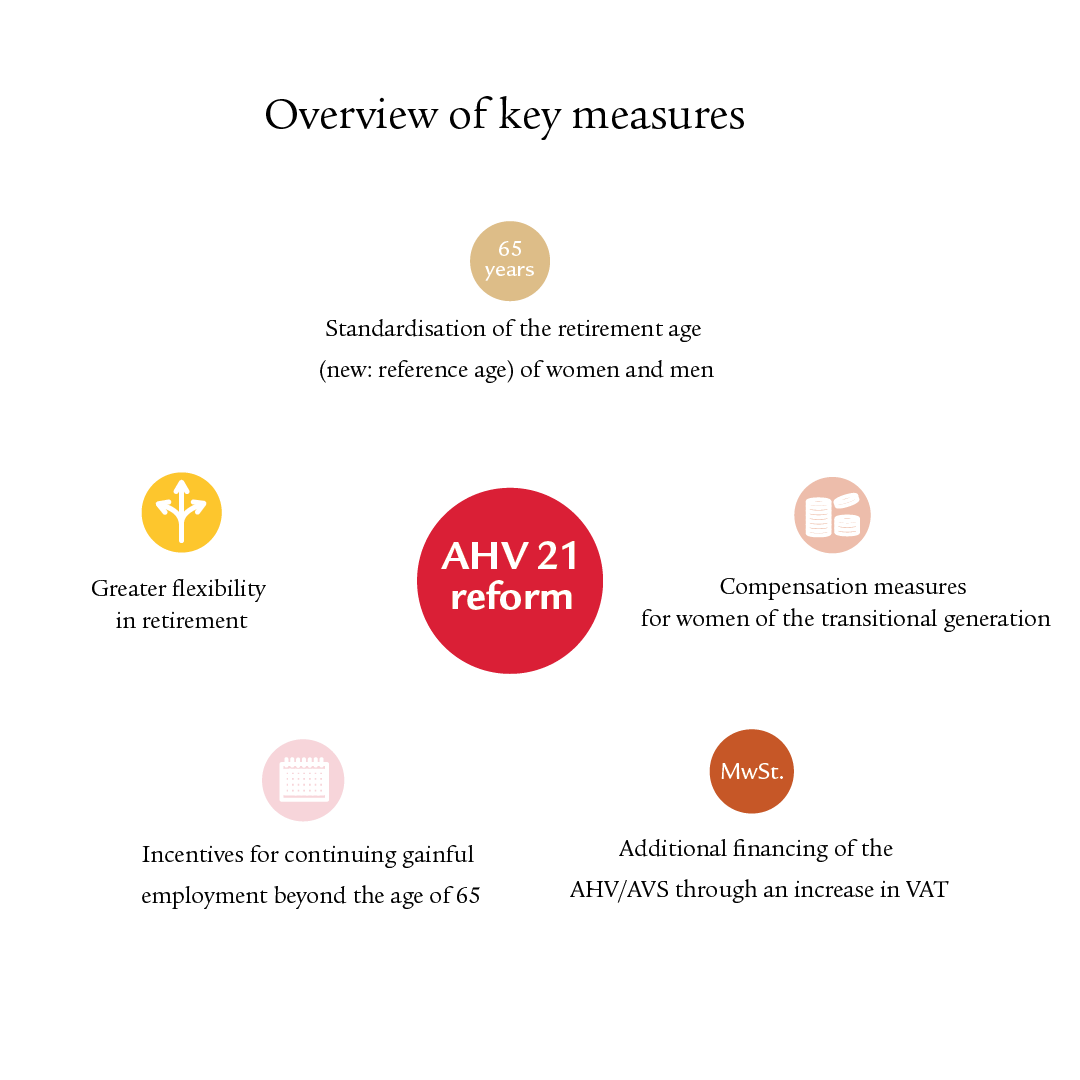

The AHV 21 reform is an important first step towards increasing the level of AHV pensions and stabilising AHV finances, with a focus on 2030.

Questions and answers

You can find out here what this means in practice and what impact the reform has

on the Swiss pension system.

What does “reference age” mean?

The term “normal retirement age” has been replaced by the term “reference age”. The reference age corresponds to the age at which the AHV pension can be drawn without deductions or supplements. The amendment also applies to the 2nd pillar.

When will the reform take effect?

The AHV 21 reform will enter into force on 1 January 2024. The reference age for women will be gradually increased from 1 January 2025.

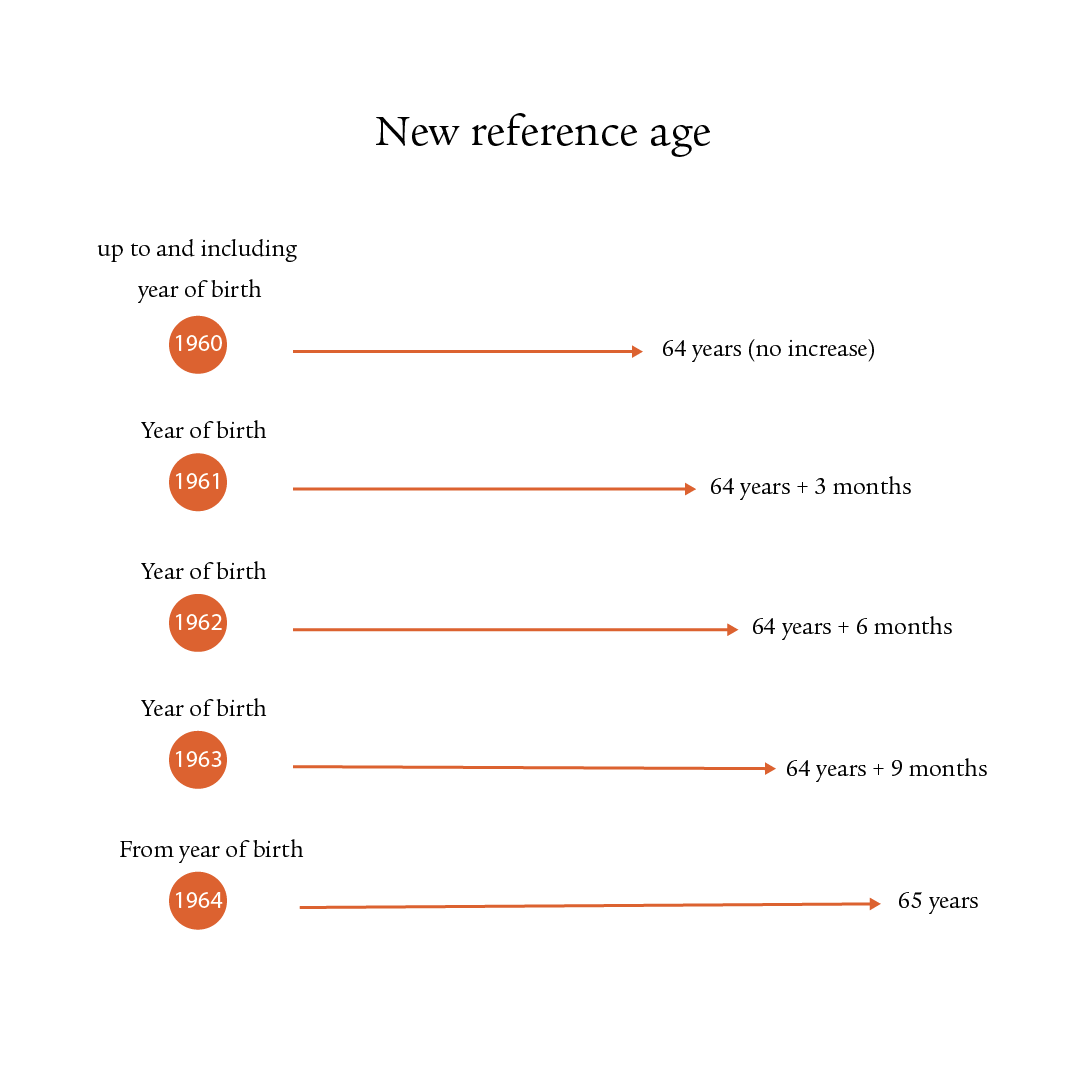

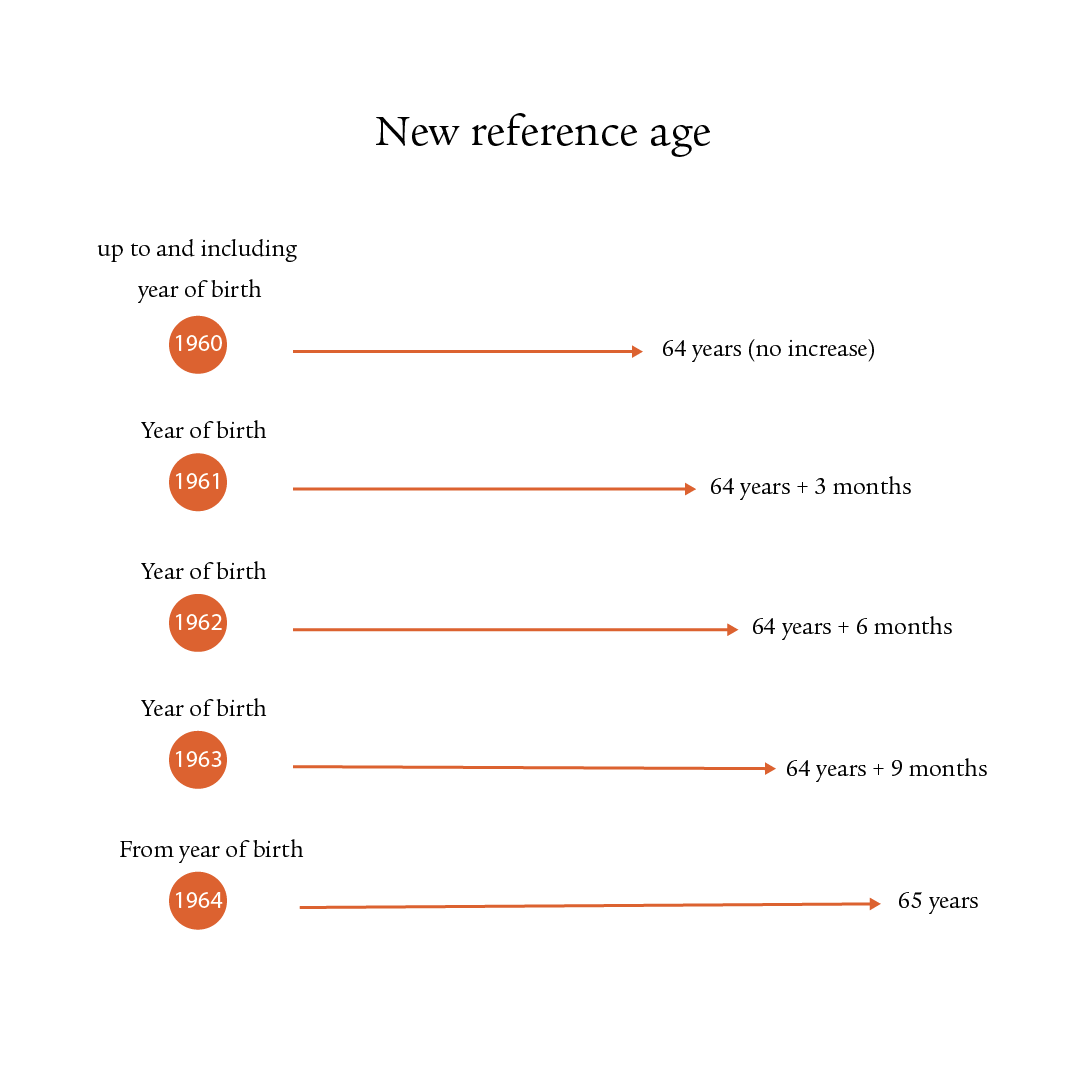

How is the reference age for women being raised?

The reference for women is being raised by 3 months each year as of 2025 from 64 to 65:

From 2029, the standard reference age of 65 will apply for women and men.

You can check your reference age here.

Are women compensated for the increase in the reference age?

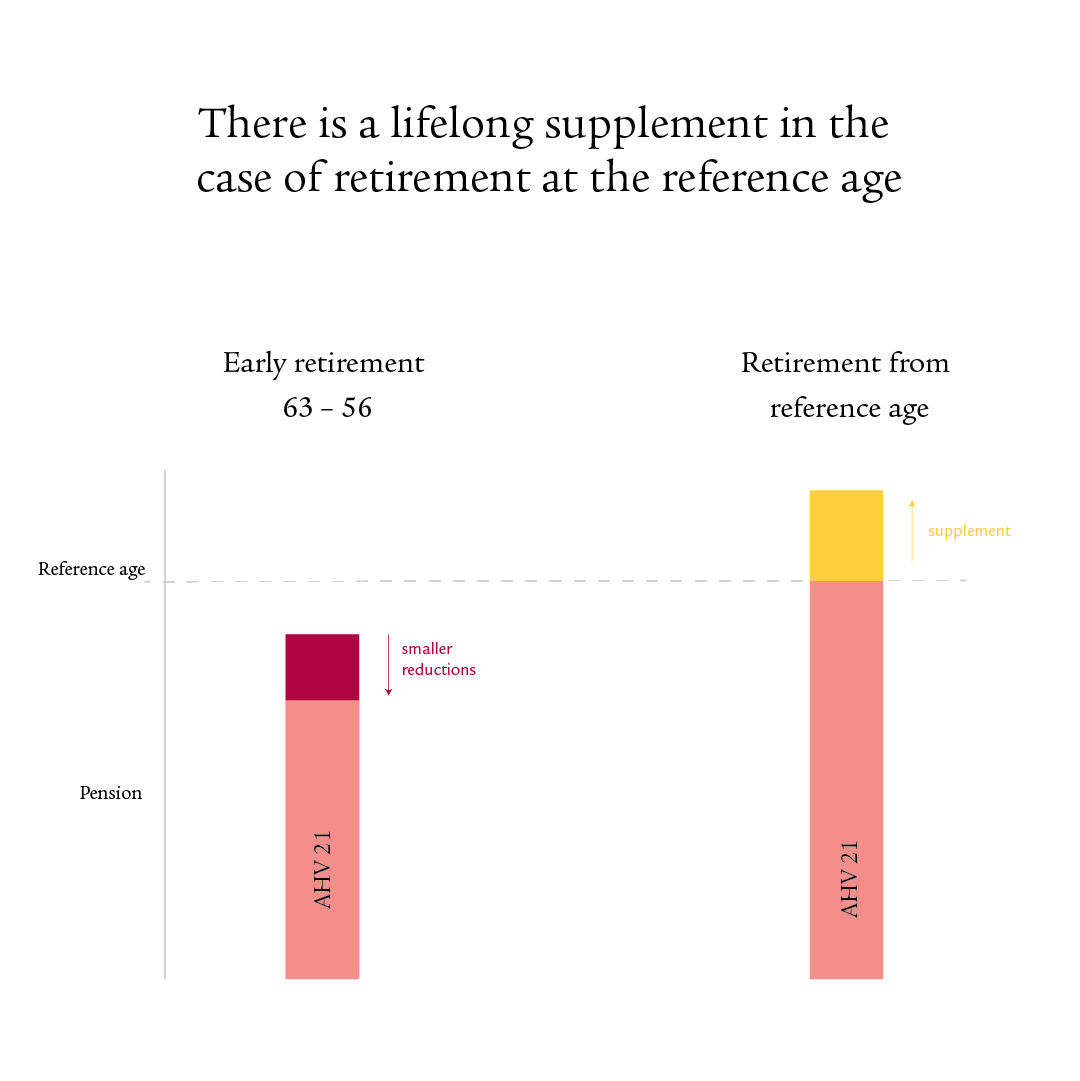

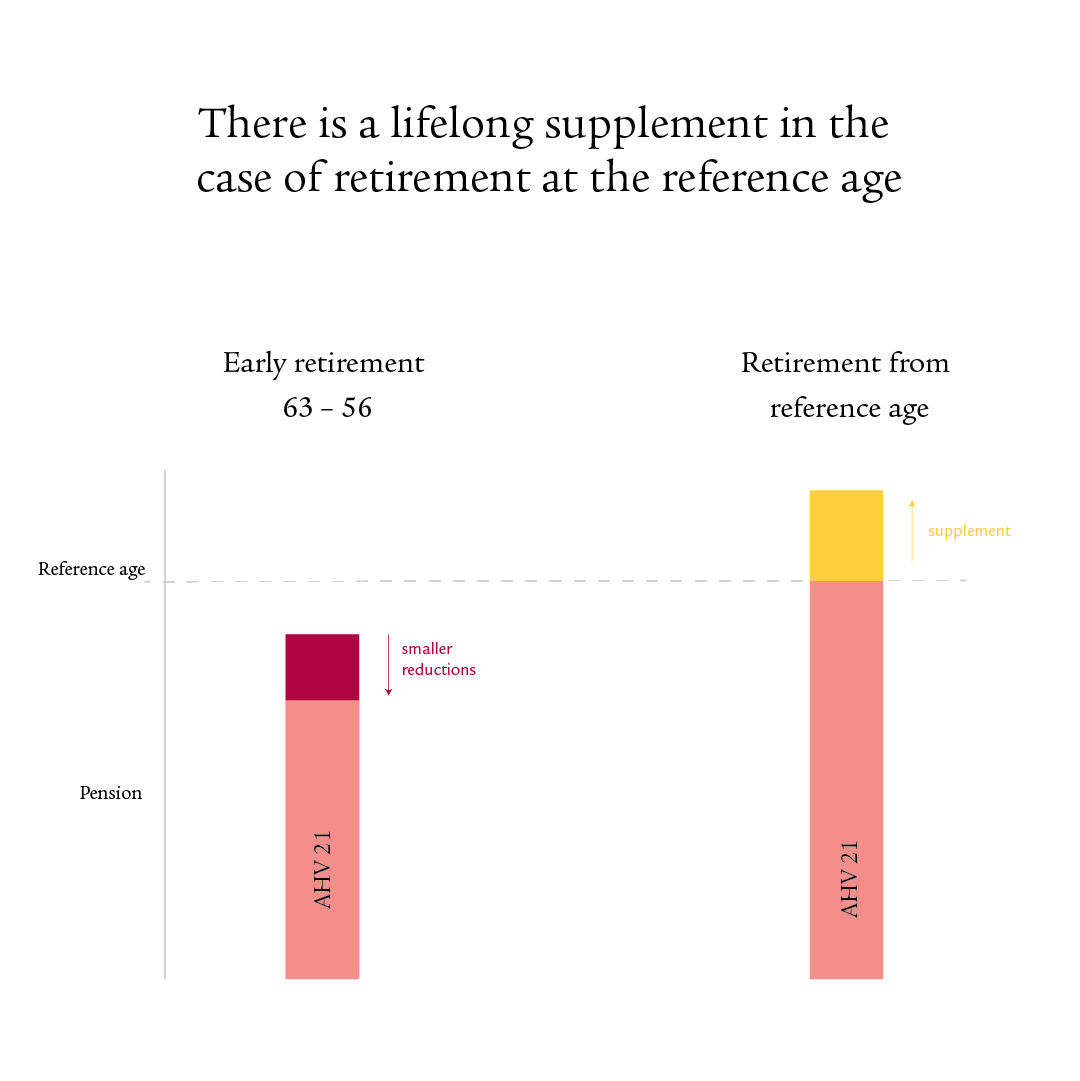

The AHV 21 reform provides for compensatory measures in the 1st pillar for women born from 1961 to 1969 (transitional generation). You benefit from:

a lifelong pension supplement if they do not draw their retirement pension early, or

a lower reduction rate if they draw their retirement pension early.

Both the supplement and the reduction rates are graded according to age and income category and can be viewed here.

Women of the transitional generation can also continue to draw their AHV pension early from the age of 62.

How is the drawing of pensions in the AHV/AVS flexible?

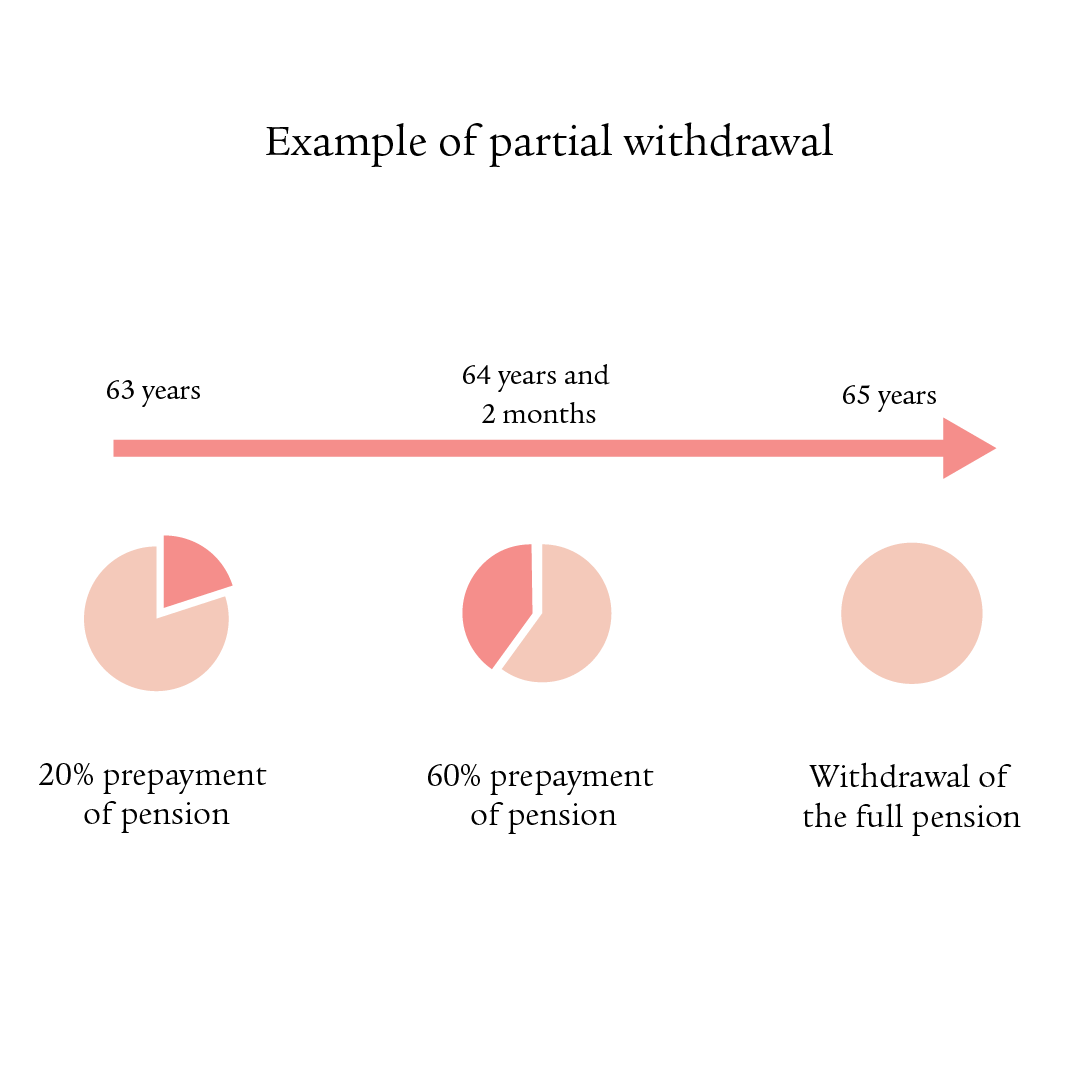

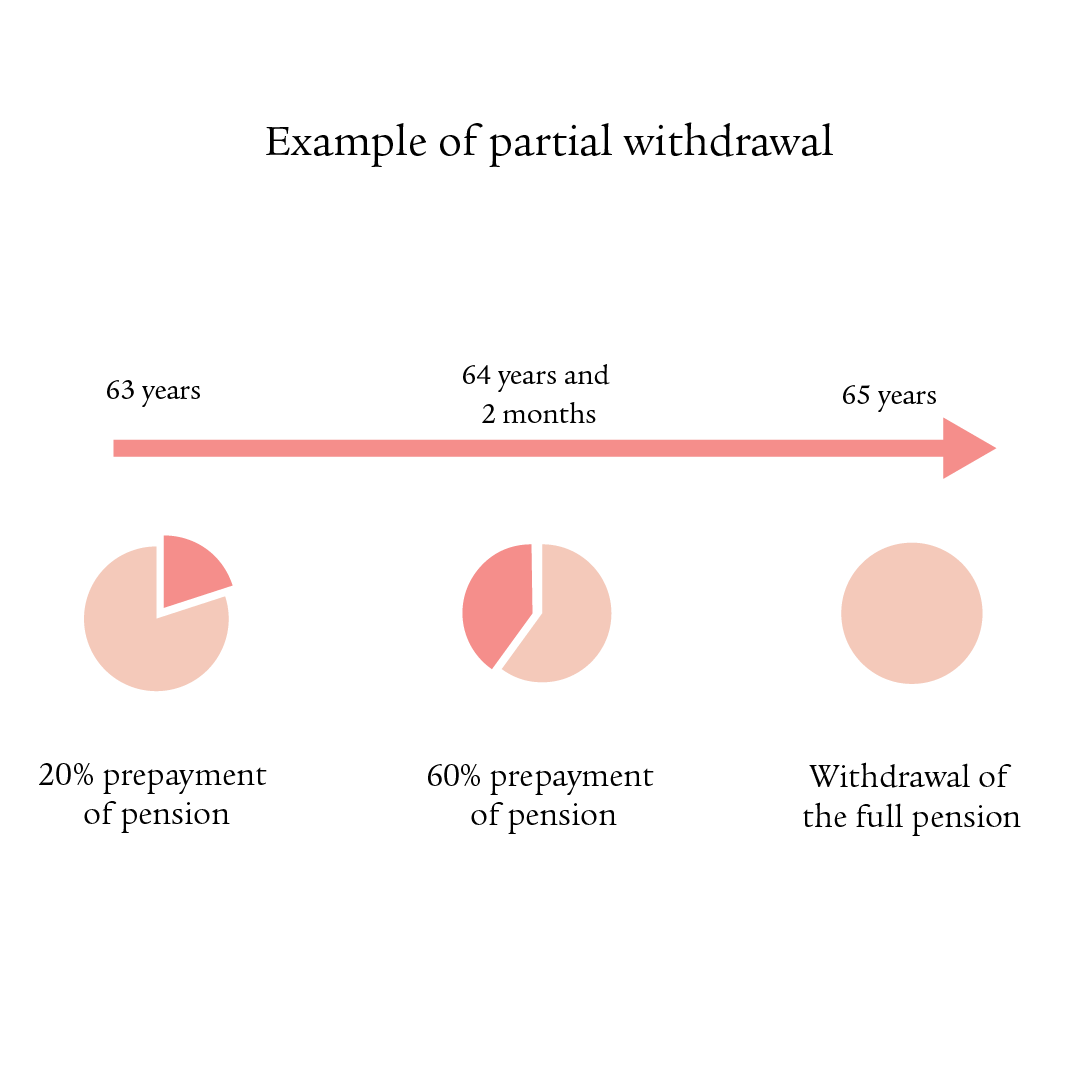

As before, an AHV pension can be drawn at the earliest two years before reaching the reference age and deferred for a maximum of five years. Early withdrawal or deferral is now possible on a monthly basis and no longer only for entire years. The pension reductions and/or supplements in the case of an early withdrawal or deferral are adjusted to average life expectancy and reduced accordingly. Partial withdrawal of the retirement pension is now also possible (min. 20%, maximum 80% of the full pension). A partial withdrawal can be increased once, after which the remaining portion of the annuity must be withdrawn in full. This means that a total of three steps are possible.

Those who work beyond the reference age and earn more than the allowance (2023: CHF 1400 per month) must continue to pay AHV contributions. However, contributions paid are now taken into account and contribution gaps can be closed. A waiver of the allowance is possible. However, if you have already reached the maximum AHV retirement pension, you cannot increase it further.

What impact does the AHV 21 reform have on occupational provisions?

The reference age for women is also being gradually increased to 65 in occupational provisions. The increase will enable women to save one year more in future. As a result, the accumulated retirement savings plus interest are higher at the time of retirement.

What will change in occupational provisions with regard to flexible retirement?

Many employee benefits institutions have already been able to make retirement benefits withdrawal more flexible in occupational provisions, but it is now enshrined in law through the AHV 21. This means that in future all employee benefits institutions must allow a prepayment of retirement benefits from the age of 63 and a deferral of retirement benefits until the age of 70 (although prepayment may still be possible from the age of 58 under the regulations). The option of partial retirement must now also be offered.

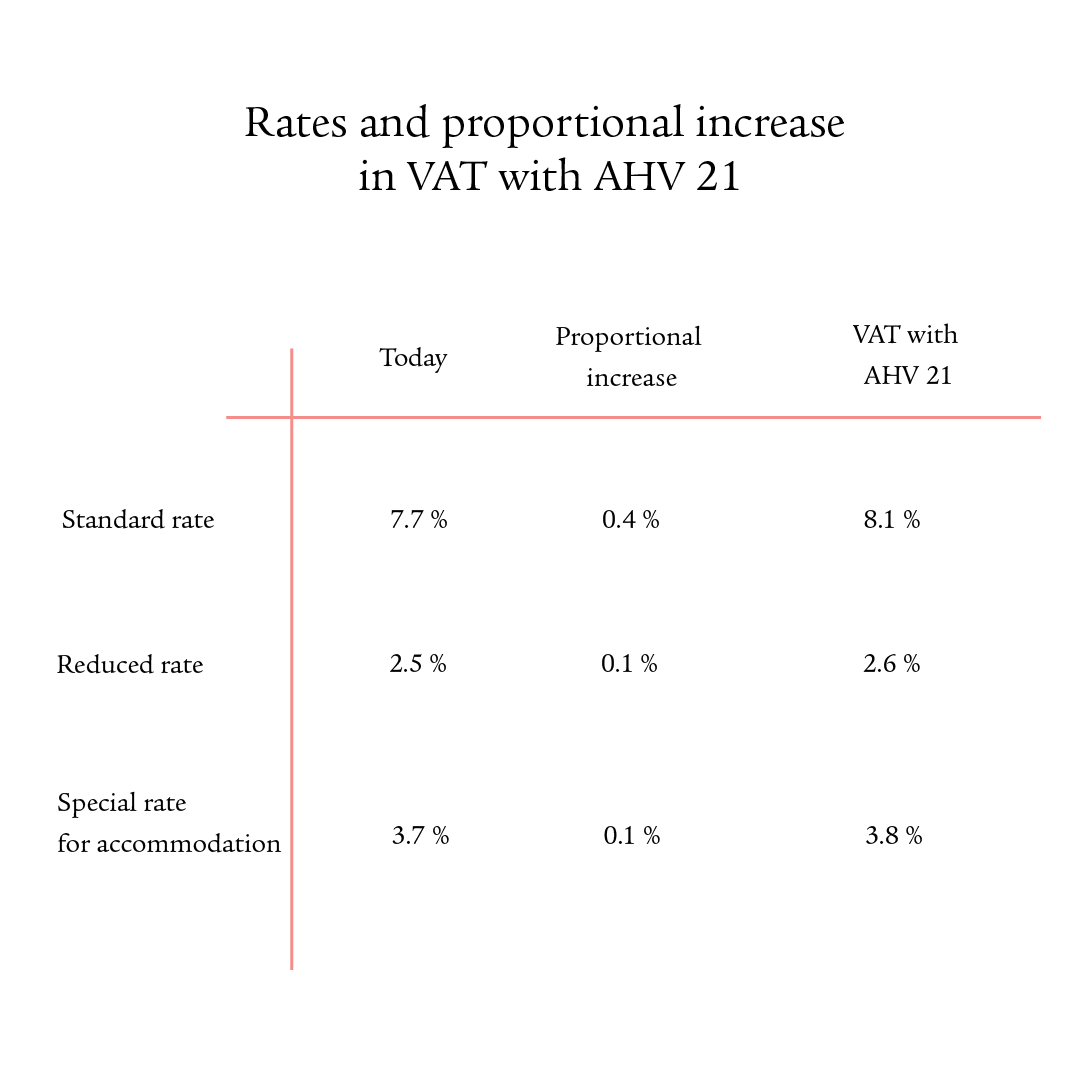

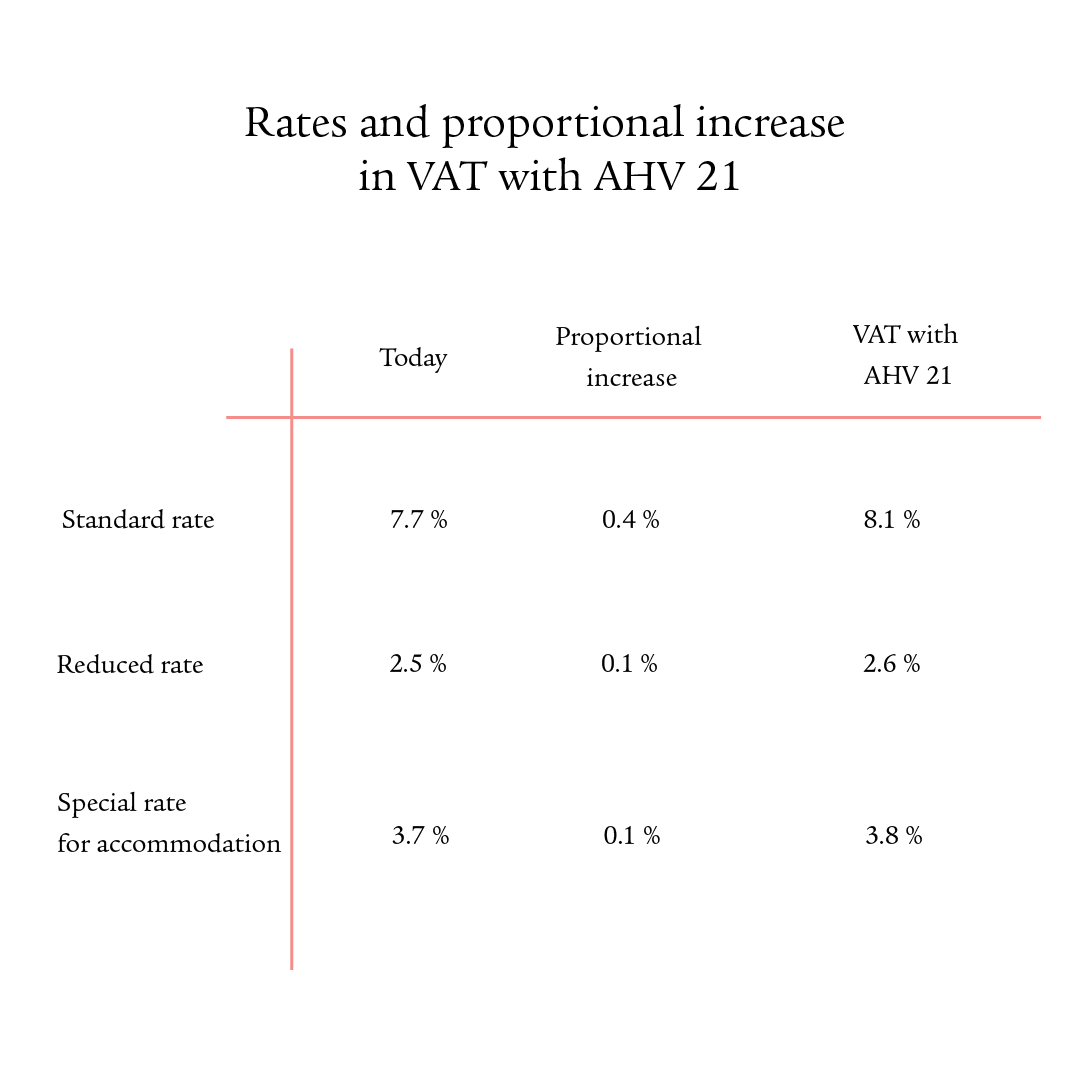

How is VAT adjusted?

In addition to raising the reference age for women, a decision was taken as part of the AHV 21 reform to finance the AHV through an increase in value-added tax. The rates of VAT will be increased as follows:

Shaping your retirement in a

self-determined manner

Careful preparation will enable you to continue realising your goals and wishes, even in old age. It is advisable to address issues such as pension provision and retirement early on, as planning your personal situation is becoming increasingly important. We would be happy to show you how to shape

your retirement in a self-determined manner.

AHV reform: We would be happy to advise you

The AHV reform affects all people who have not yet retired. Our experts can help you with all questions relating to your personal pension situation and show you how to close pension gaps.