Sustainability is the buzzword of our times. Green money and sustainable investments are also concepts that feature prominently in the world of finance. In fact, the subject is complex. We present the five most common myths and ask our sustainability expert Rico Keller for his assessment of them.

According to the EU Commission, Europe needs an estimated EUR 180 billion per year of climate-friendly investment to achieve the European climate targets – and the financial sector has a key role to play. The aim is to channel money into sustainable investments and make a decisive contribution to a climate-neutral and circular economy.

Would you like to make a self-determined choice about how your money is invested? One good option is to invest in a sustainable pension. Why? Depending on how early you start paying in, your pillar 3a assets have time to grow over many years. This can have a long-term positive effect for you and for the environment.

The term sustainability is also very often used in a financial context. Many people do not understand what exactly sustainable investments are and what they can achieve. Here we list five common myths about sustainable investing. Rico Keller, sustainability expert at Swiss Life Asset Managers, provides his assessment and clears up any misconceptions.

Myth 1: There are no binding rules for sustainable investments.

Rico Keller: «Yes, there are. The EU Sustainable Finance Disclosure Regulation (SFDR) clearly defines what constitutes sustainable investment.»

The SFDR distinguishes between two types of sustainable funds:

- ESG (SFDR Art. 8)

- Impact (SFDR Art. 9)

ESG funds must significantly outperform their peers (e.g. MSCI World) in terms of environmental, social and governance factors. They often also have a corresponding label.

Impact funds go a significant step further: they must have a measurable impact in the real world. As well as generating financial returns, they must also achieve environmental or social outcomes. For example, an impact fund may aim to provide more water treatment or produce more renewable energy. Swiss Life has defined clear guidelines on what constitutes a sustainable fund.

Admittedly, there is still some catching up to do with regard to standards. For example, the SFDR only states what information a financial product needs to disclose in order to qualify as ESG or Impact, rather than defining clear sustainability goals per se.

One thing is certain: the scientific basis and understanding of the subject have been steadily increasing for years, which will help further clarify uncertainties. Given the increasing interest of investors, it is only a matter of time before more clear and binding rules follow.

Myth 2: Investing sustainably means lower returns.

Rico Keller: “No, you can’t make such a sweeping statement. Various analyses from the past few years have shown that the results are neither better nor worse than those achieved by conventional investment products. The returns are comparable. In the past, there have also been some examples of sustainable funds achieving above-average results. It’s important to remember that any activity on equity markets entails a certain degree of risk – whether sustainable or unsustainable.»

How profitable an investment is also depends on whether the portfolio is managed actively or passively. With active management, experts constantly assess the market environment and try to achieve the best possible performance. Sustainability and profitability are therefore definitely not mutually exclusive.

Myth 3: Sustainable investment will not last – it’s all just hype.

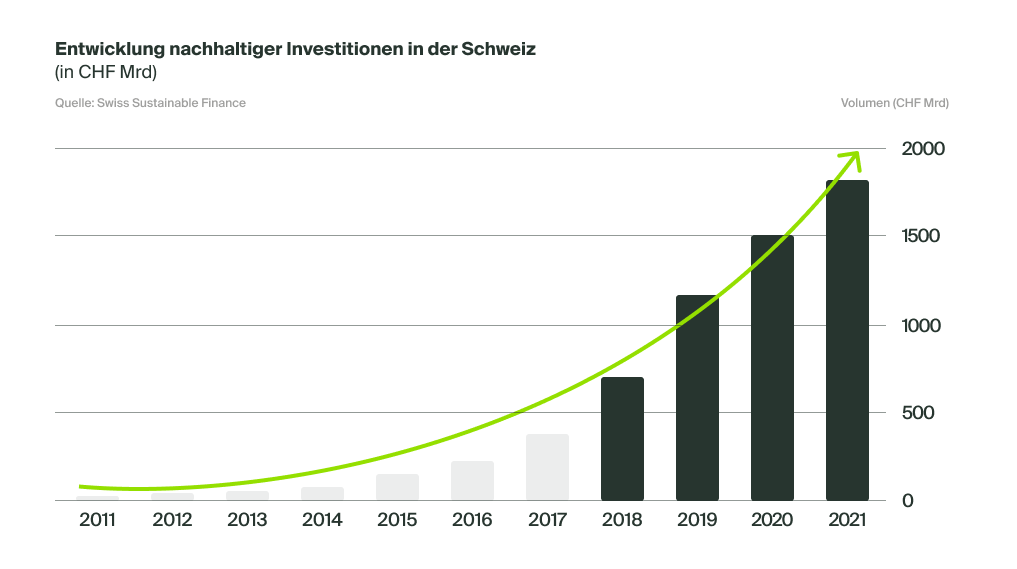

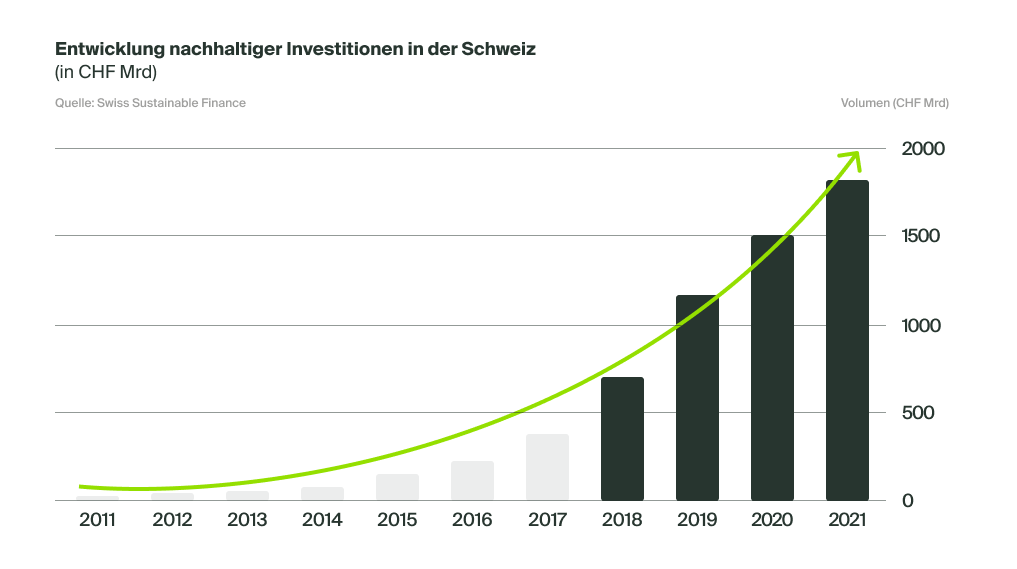

Rico Keller: «That’s not true. Hype refers to something that is short-lived in nature. Sustainable investments, on the other hand, have grown significantly over the past ten years, as the current market study by Swiss Sustainable Finance shows. It's interesting to note that since 2018, the volume of investments designated as sustainable has increased by at least 30% year on year.»

According to the World Economic Forum (WEF), three major risks will dominate the global economy for the next decade: climate risks, extreme weather events and loss of biodiversity. This shows that these risks are not only recognised by society as a whole, but also by decision-makers from business and politics. The pressure on companies to address these risks and to find solutions will keep growing.

Myth 4: I can’t be sure that my sustainable investment is really making a difference.

Rico Keller: «You can be sure that your investment will make an impact, but only if the positive effect is made measurable.» Whether in terms of sustainable mobility or shopping, not all actions have the same effect. Foregoing air travel has a much greater impact than not using your motorised scooter. The principle is similar for investments.

Investments have different effects: for example, if you invest your money directly in a solar system, you are making a very direct and effective contribution to climate protection. In comparison, the effect is an indirect one if you invest in the shares of a solar energy company.

Myth 5: Sustainability is all about nature – and this is very limiting.

Rico Keller: «That’s not true. You can refer to the UN’s Sustainable Development Goals (SDGs), for example, as a guide. With these 17 goals, the United Nations has defined the blueprint for sustainable development. A minority of these are actually concerned with nature. SDG 1 and SDG 2, for example, are clearly aimed at combating hunger and poverty. Of course, there are SDGs relating to the environment, such as Life on Land and Life below Water, but issues like innovation, equality and responsible consumption and production are also on the list. These SDGs often provide a reference framework for thematic impact funds.»

About Rico Keller

Rico Keller is a Responsible Investment Manager at Swiss Life Asset Managers. He completed his Master’s degree in environmental sciences at ETH Zurich in 2019. His work makes an important contribution to Swiss Life’s sustainable investment approach.