Death is often unexpected. That’s why it’s never too early to plan the related issues in accordance with your wishes: intestate succession is the default when a person dies, but can be avoided with a will, which allows you to specify your final wishes.

-

2/3 of Swiss inherit

-

The average bequest is CHF 178'000

-

72% of heirs are already over 50 years of age, a full 28% are already receiving an AHV pension

Relevant FAQs

The five basic rules of inheritance

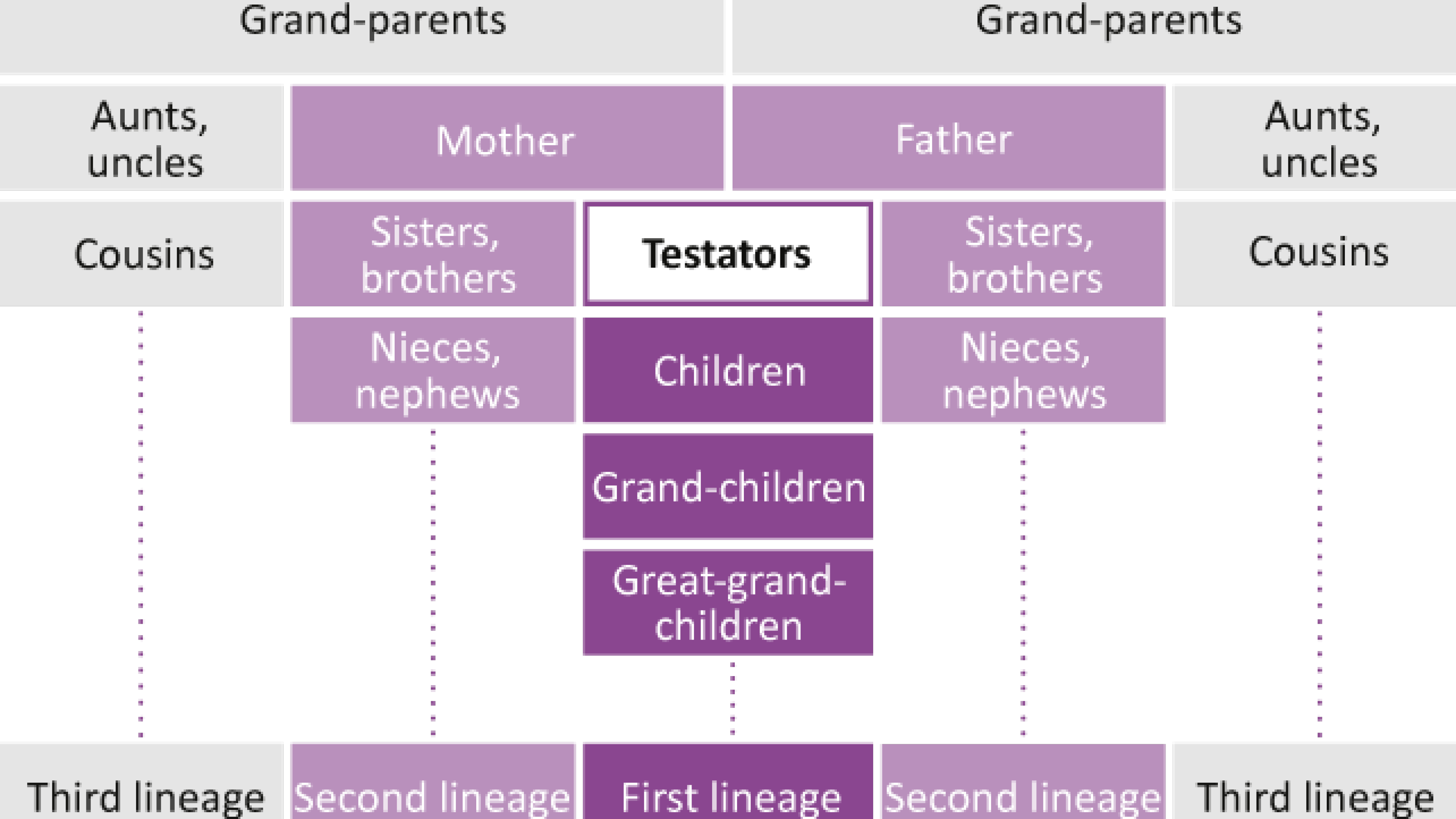

- The surviving spouse/registered partner always inherits.

- Close family members (lineage) take precedence over more distant ones in the order of succession.

- If a legal heir who is related by blood has already died, his/her share will go to his/her descendants.

- If the parental family line (second lineage) is next in the order of succession, the paternal side and the maternal side will inherit equal shares among themselves.

- If the grandparental line is next in the order of succession (third lineage), the grandparental lines will inherit equal shares among themselves.

Do you agree that your assets should be divided among your blood relatives as prescribed by the rules of intestate succession? If that is what you want, then you do not need to make a will. But what if you want to bequeath the freely disposable portion to someone else? For example, to someone you are fond of or a charity? In such cases, a valid will is essential to make sure your estate is divided as you wish.

Your digital footprint is probably bigger than you think. Most social networks collect and evaluate your data and use it for other purposes. In the event of death, it is often difficult or even impossible for relatives to gain access to all relevant accounts, cloud archives and profiles. Many people therefore give up trying and cannot prevent the continued receipt of birthday reminders or contact invitations for the deceased for many years.

How to proceed: many online platforms do not have satisfactory solutions for relatives who want to close down accounts and delete data relating to a deceased person. One of the easiest and most effective solutions is to store access data for all profiles and online accounts in a safe place. Give access authorisation to one or more people you trust.

A gift is the “allocation during one’s life of an asset free of charge”. Depending on the composition of heirs, a gift can or must be considered in the event of inheritance.

Plan your estate

Want to make sure your assets are distributed in accordance with your wishes? We recommend planning your estate as early as possible. Many people do not start thinking about their estate until they’re in their 50s. But life often turns out differently than expected.

Make an appointment for a consultation

We would be pleased to provide you with more information – in a personal and non-binding consultation. We would also be happy to advise you by video instead of in the General Agency or at your home.