Owning a house or apartment also entails maintenance costs and obligations. We provide an overview of what to expect.

Obligations of house owners

Owning your own home gives you plenty of freedom in its design. At the same time, however, there are also some obligations to be observed: for example, no-one may be impaired by your property. In addition, you are also responsible for maintaining safety around your property, for example by clearing and gritting snow. If someone slips on your property, you may be held liable. Swiss Life Home in One offers you optimum liability protection in such cases.

Regular checks

You should check your house regularly:

- regular checking of electrical installations is prescribed by the Ordinance on Electrical Low-Voltage Installations (LVIO).

- regular checking of oil and gas heating systems as well as wood-fired systems by the chimney sweep is prescribed by the Air Pollution Control Ordinance (OAPC).

Excessive impairment

Homeowners may not excessively impair or cause actual damage to their neighbours with their property (according to Art. 684 of the Swiss Civil Code). Impairments such as annoying odours, smoke, soot or noise, as well as aesthetic impairments can be disruptive to the neighbourhood. A compost heap directly on the property boundary or a disruptive air conditioning system at the boundary wall would therefore be problematic. In the event of a dispute, a court will examine the disputed emissions.

Preservation of property value

Maintenance obligations include preserving the value of the property. Failure to care for the interior and the exterior façade can have a negative impact on the property that may also cause the resale price to fall significantly.

Maintenance obligation for freehold apartments

Freehold apartments are a special type of ownership. They comprise co-ownership of a localised part of the building, usually an apartment within an apartment building. If you own a freehold apartment, you have a different maintenance obligation than if you own a house with your own land, as you are attached to a property. Maintenance is governed by a community of owners.

Damage or defects

The maintenance of communal rooms or parts of the property is organised within the community, often via a presiding property manager. Costs arising from damage or defects to communal parts of buildings are apportioned according to each owner’s value share. You are responsible for the share of the building you own yourself.

Renovation work

Renovation costs are financed within the community of owners by means of a renovation fund. All owners pay in a fixed contribution each year. This way, sudden investments do not place too much strain on their finances.

Tip: Carry out an analysis of the property’s condition right at the start. This will allow you to assess whether the agreed renovation fund will be sufficient in the long term or whether you should increase your reserves.

What maintenance costs must I expect?

Building maintenance for houses and apartments that are new, newly renovated or in good condition is generally calculated as one percent of the purchase price per year. This thus equates to approximately CHF 10 000 per year for a property purchased for CHF 1 000 000. This amount is intended to cover ancillary costs, ongoing building maintenance and major acquisitions and renovation work.

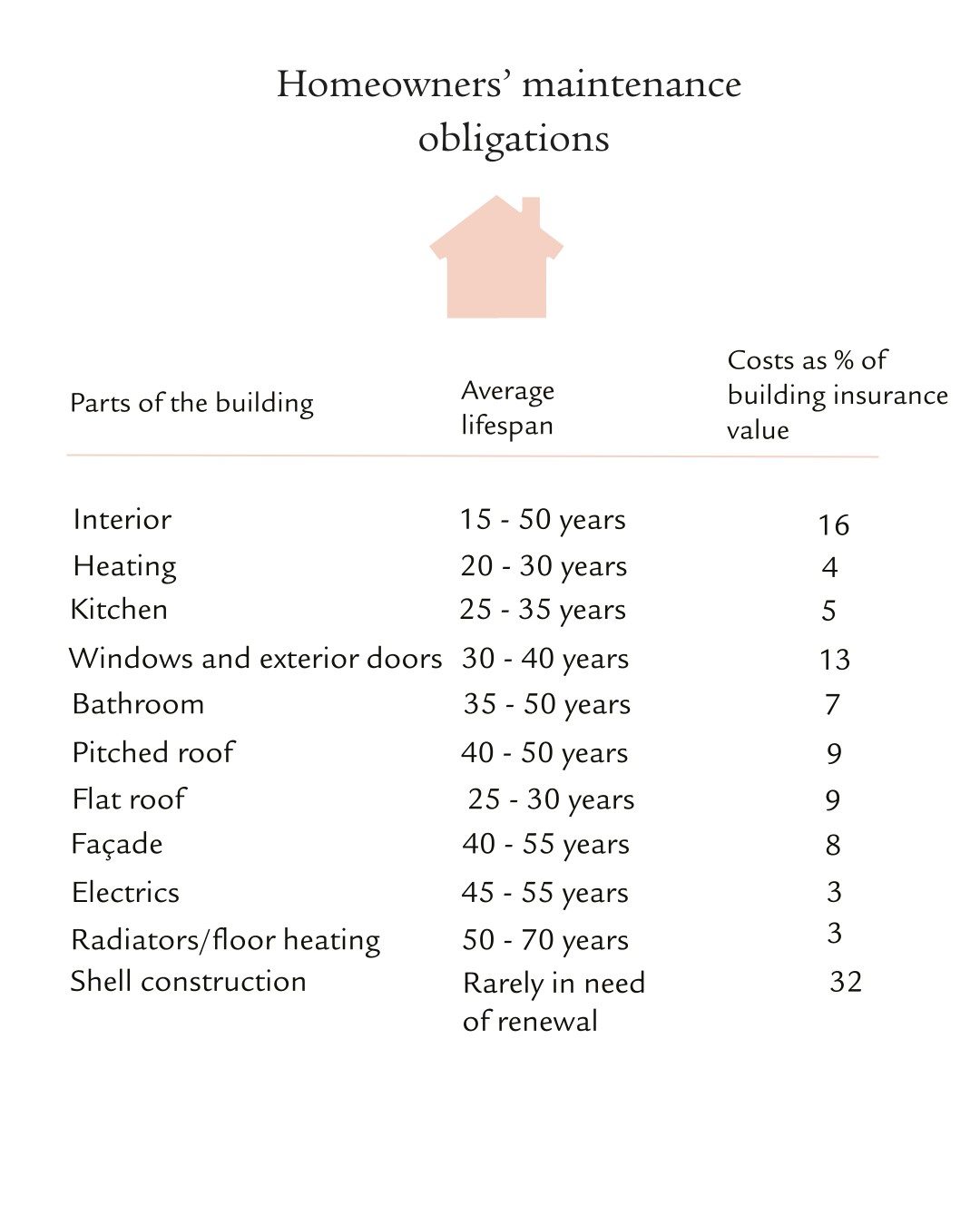

Overview of the average lifespan of different parts of a building: