Your home needs regular maintenance. Depending on its age and changing living requirements, renovations or conversions may be necessary. There are a number of ways to finance this.

Reserves for refurbishments

Regular maintenance of your home pays off in the long term. Firstly, ongoing and regular building maintenance preserves the value of the property, since this falls for run-down properties. Secondly, it prevents possible damage which ultimately results in much higher costs than regular, careful maintenance work.

Account for reserves

A simple solution is to transfer the reserves for building maintenance each month by standing order to an account opened specifically for this purpose. The money is then immediately available to you if you need to repair or replace something.

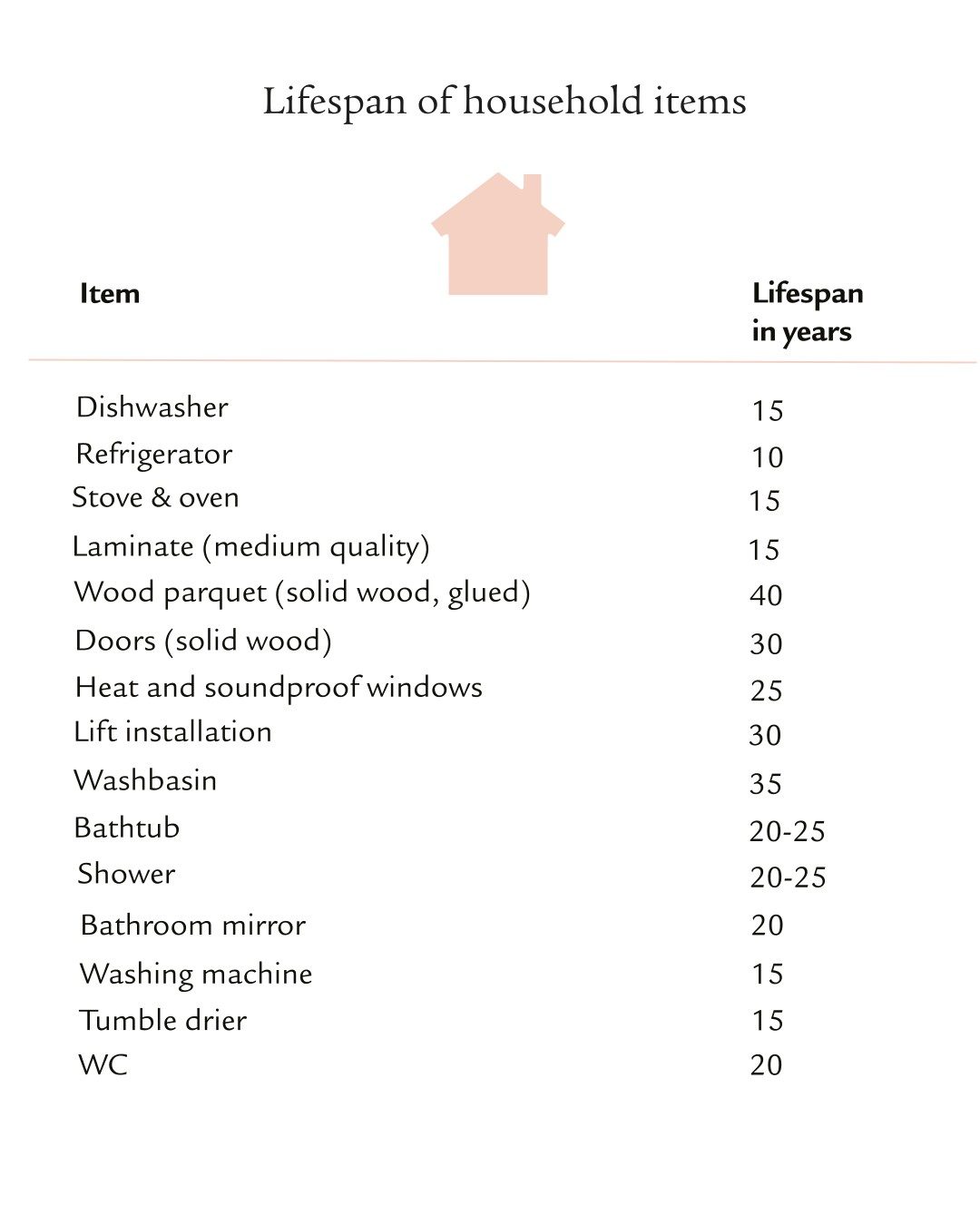

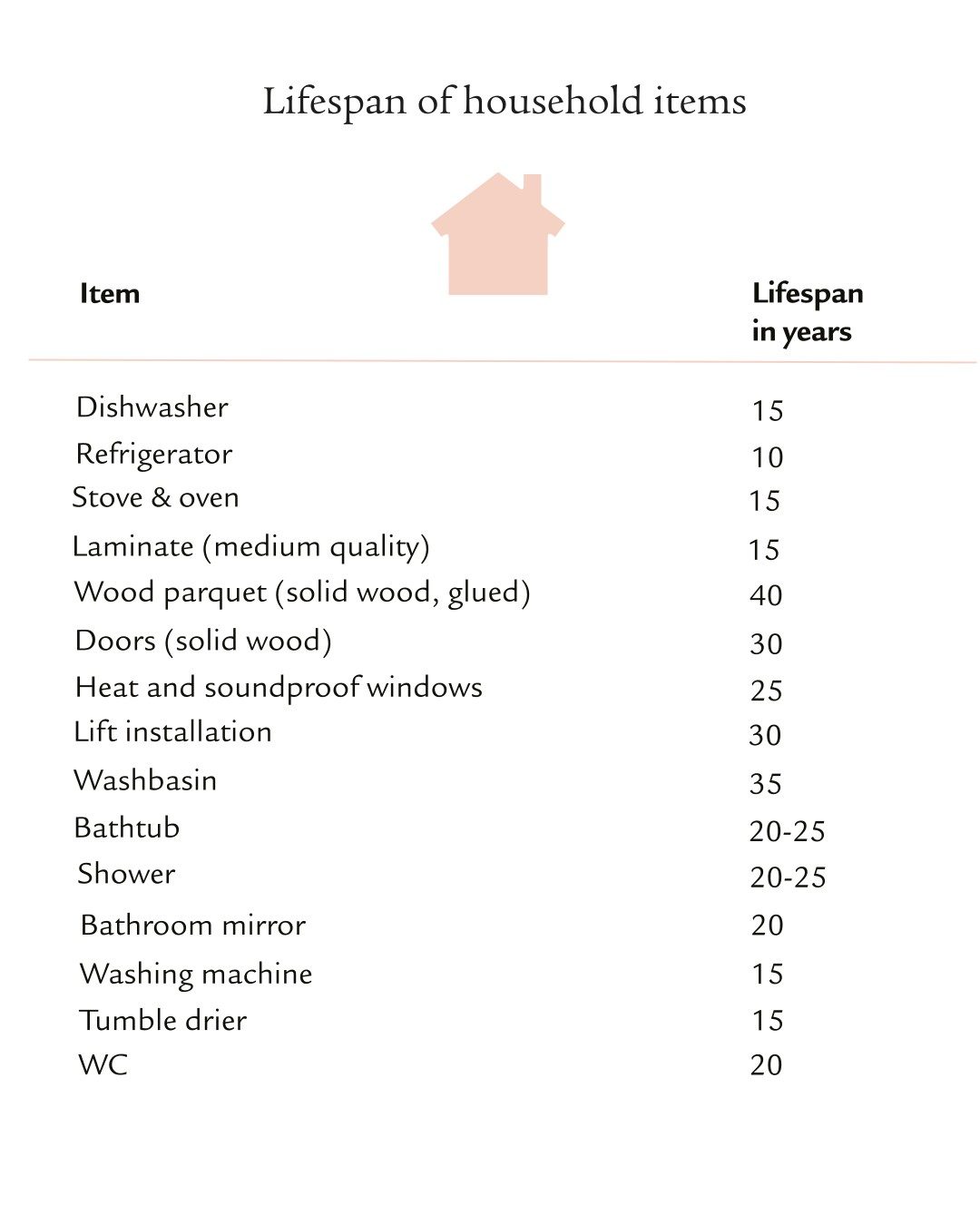

Lifespan table of property items

Amount of reserves

As a rule, banks and insurance companies reckon on annual reserves of 1% of the purchase price for new or newly renovated properties. You should therefore put aside CHF 10 000 a year for a single-family home costing CHF 1 million. Two thirds of this amount will be used to pay ancillary costs, such as connection fees and insurance, as well as ongoing maintenance. The remainder will be used for major purchases and renovation work. In the case of unrenovated old buildings, however, this amount is often insufficient to be financially prepared for all eventualities. If the building is in major need of refurbishment, you need to determine the amount of the required provisions individually.

Did you know? With myEnergyGuide you can put together an individual solution based on your wishes for the long-term value preservation of your property.

Make an appointment for a consultation

Our experts at Swiss Life and Swiss Life Select would be happy to advise you about the various financing options for your conversion or renovation – at a location of your choice or online by video.

Financing options for maintenance and renovation

Each component installed in a home has a different, limited lifespan. As a homeowner, therefore, you will sooner or later have to carry out conversions, renovations or refurbishments. You should be able to finance smaller jobs from your reserves for ongoing maintenance. Major renovations and refurbishments and environmentally-friendly conversions need to be budgeted differently.

Top up your mortgage

You can take out a mortgage or top up an existing one to finance conversions, renovations and refurbishments. However, please note the following:

Banks finance value-adding measures, such as a new conservatory, but only up to 80 percent of the costs. Mortgage lenders will usually also check your current income when increasing mortgages and carry out a new real estate valuation. The amount of the mortgage increase is determined individually based on the newly calculated creditworthiness. Please note that financial institutions start assessing affordability in retirement age from the age of 50.

Withdraw pension assets

Another financing option comprises your assets from pillar 2 and 3 pension provisions. Every five years you can withdraw pension assets to finance conversions, renovations or refurbishments. Five years before normal retirement age you may redeem your tax-qualified provisions (pillars 2 and 3a) for other purposes. The lump-sum payment is taxed at a reduced rate. Please note: pension fund and pillar 3 assets may also be withdrawn early for value-enhancing measures.

If you have pledged your pension plan assets, you require the consent of your mortgage lender. As with topping up a mortgage, your income situation and the value of your property will be reassessed before the pledged assets are released. If your pension plan assets are not (yet) pledged, you can use them to improve your creditworthiness for the financing of conversions or renovations.

Apply for subsidies

You can benefit from subsidies for certain conversion measures. For environmentally-friendly conversions, you can apply for subsidies from the federal government, your canton, your city or municipality and from your regional electricity and gas supplier. Enter your postcode on the website of energiefranken.ch to find an overview of all the funding measures.