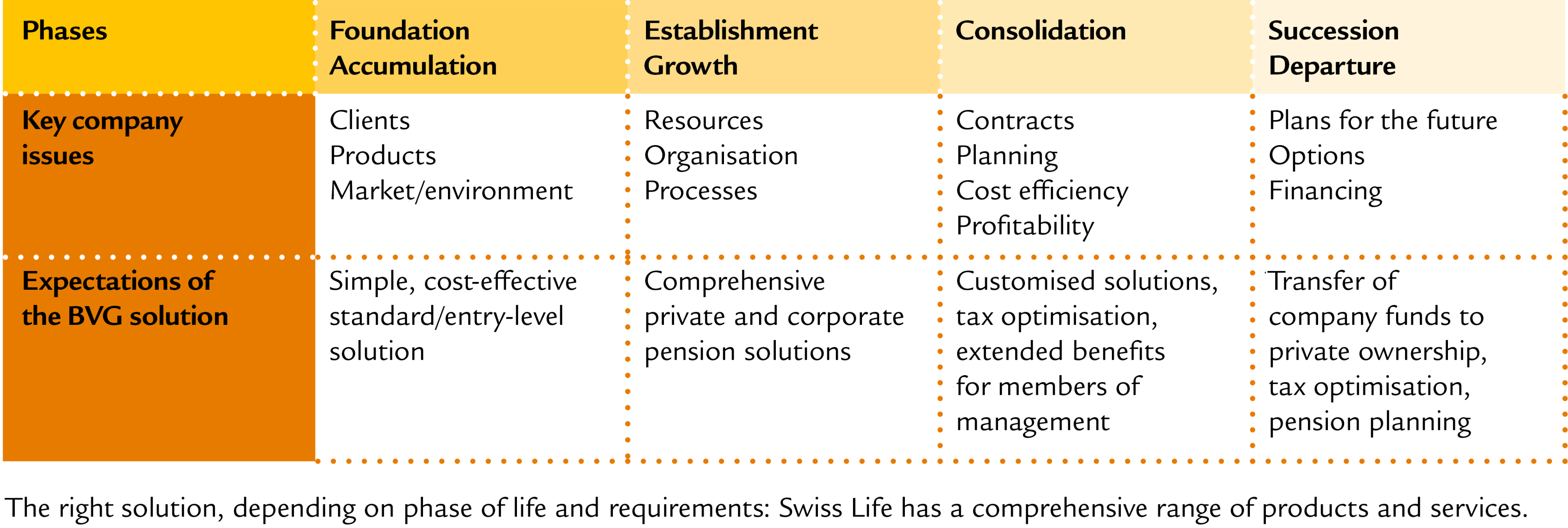

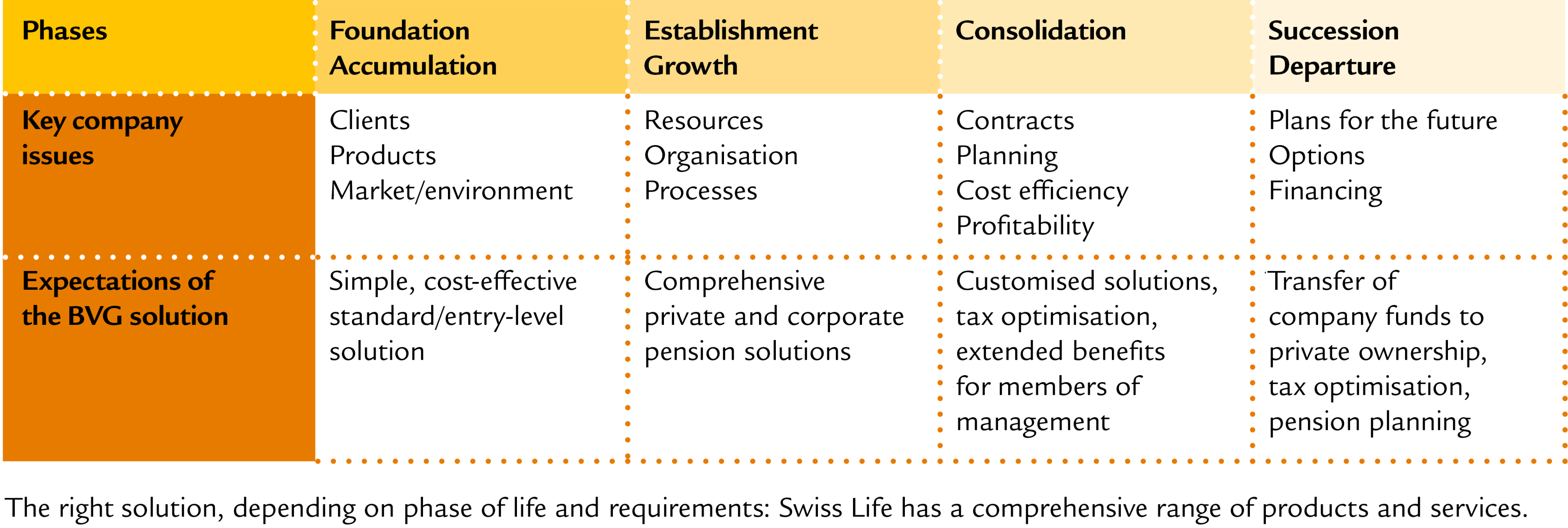

Companies go through various phases. With each one, the company’s requirements in terms of occupational provisions change. This is a strategic topic that is becoming more and more important.

Four phases – with different priorities

You found a company, watch it grow, consolidate the success and then hand it over to a successor. Provisions continue to be a topic in the background during each of these four phases. In an age when we are living longer and more comfortably, the importance of intelligent provisions is becoming more important as well.

Foundation phase

Are you thinking about following your dreams and becoming self-employed? A lot needs to be done: a business plan has to be drawn up, the financing clarified, and formalities observed. Becoming self-employed is a big moment – for your coverage as well.

Financial protection in the event of disability and pension provisions are often neglected during the initial phase. And yet company founders, employees and family members are exposed to countless risks: they can become ill or suffer an accident. And you’re responsible for your products.

Swiss Life is happy to assist you as you commence self-employment – whether you’re looking for a pillar 3a solution or an affiliation with a second pillar employee benefits institution.

Growth phase

Your company is established and growing. By now, an investment in key employees is essential for further success. In any case, greater staff retention only offers advantages.

During this phase, occupational provisions present a strong argument. Whether you are perceived as an attractive employer is also determined by the pension benefits you offer. Specialists and managers are especially receptive to attractive solutions.

Consolidation phase

Is your company in the consolidation phase? Are you trying to ensure profitability, reduce costs and optimise taxes? A flexible occupational provisions solution will help you in several respects.

A tailored solution will help you retain top performers at your company. It will also help to motivate them to go the extra mile for your company. And once the solution has been set up properly, you and your companies will also be able to sustainably optimise taxes.

Succession phase

During the succession phase you want to plan for retirement and possibly transfer some of the company’s assets to private ownership.

During this phase as well, it is important for all involved to have an experienced partner at their side, one who can provide them with expert advice in all aspects related to this topic.

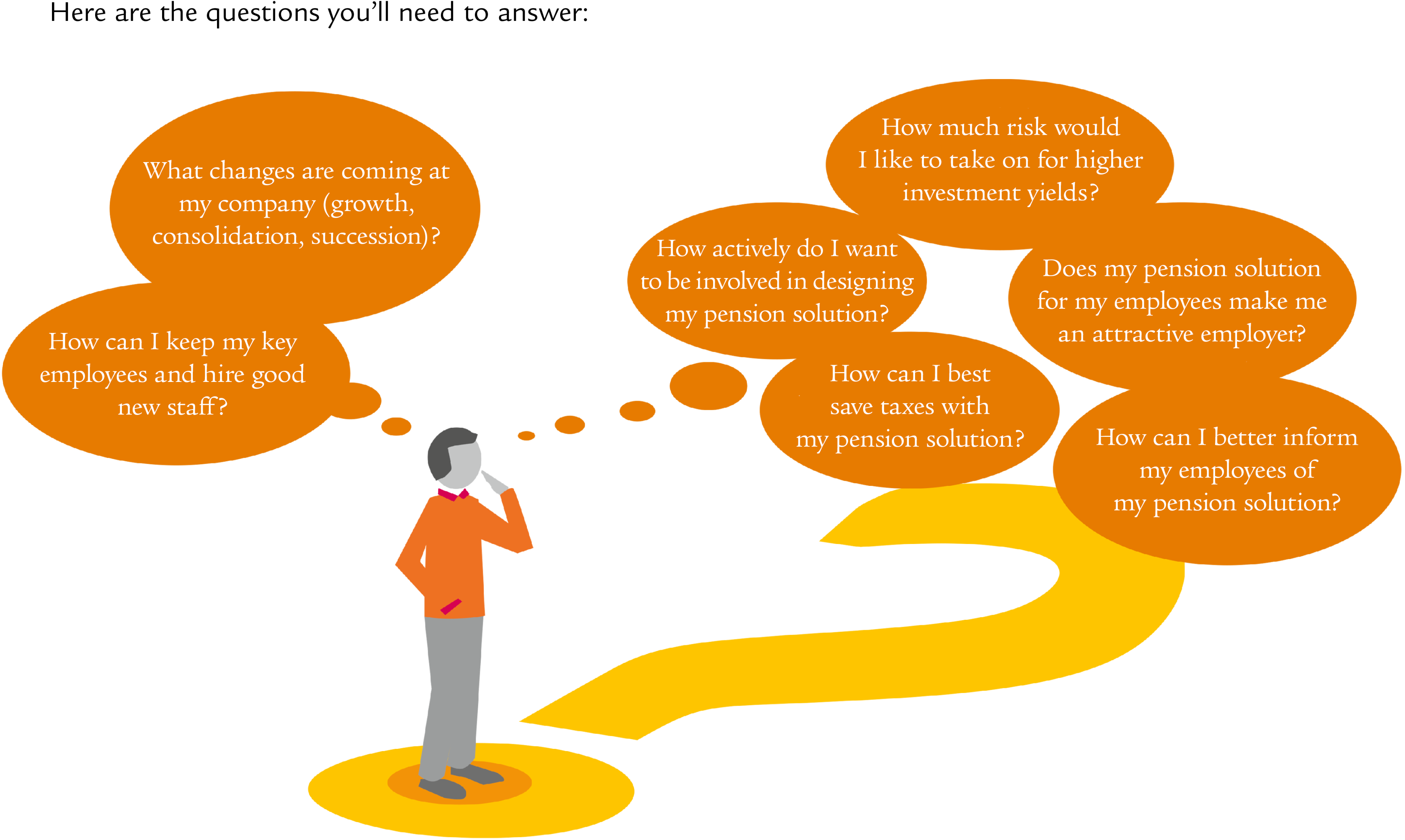

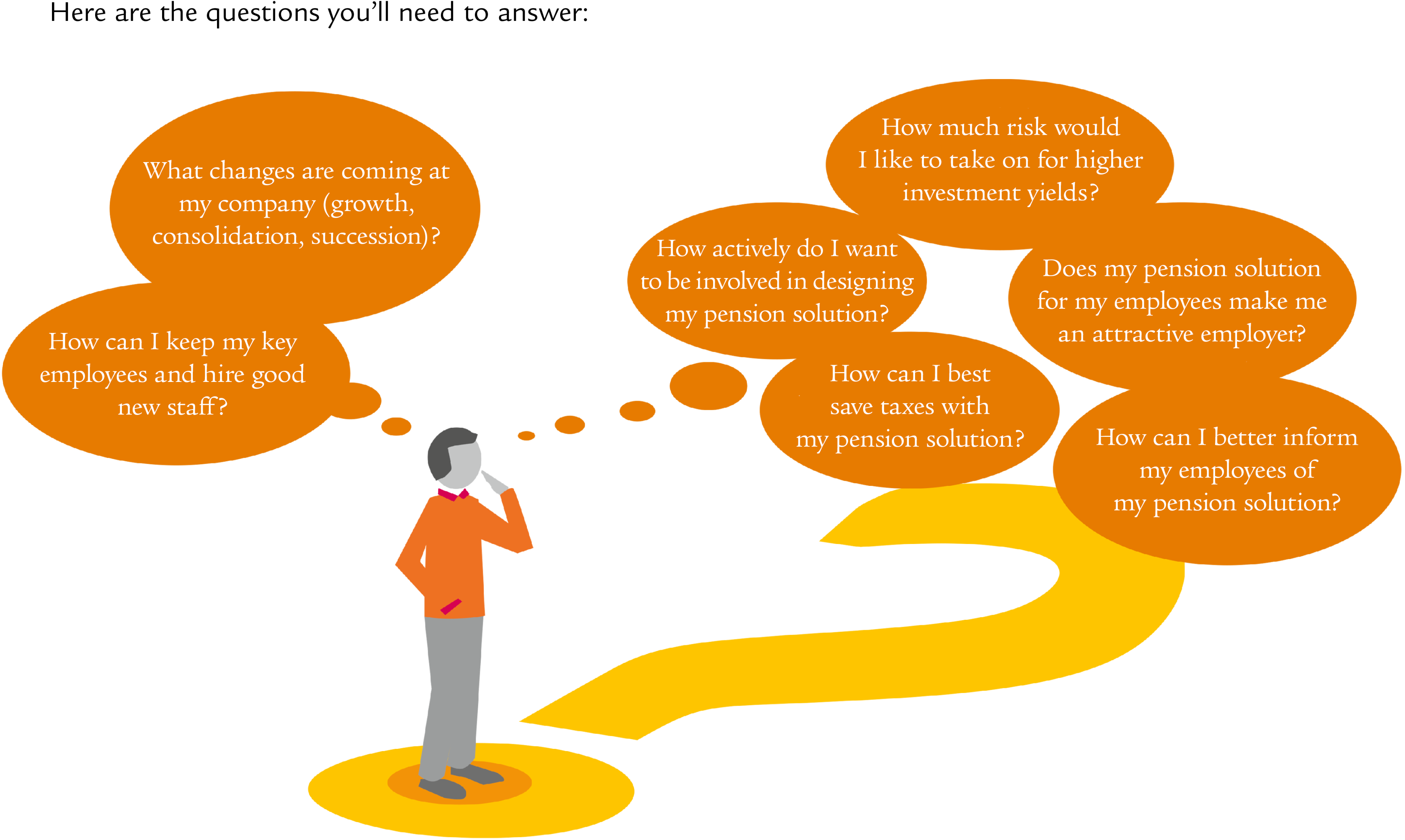

Which of these phases is your company in? Are changes imminent? Our advisors would be pleased to discuss your questions and needs, and develop tailored solutions for you.