Occupational provisions offer little flexibility for individuality. With one exception: with the so-called “1e solutions”, you and your employees can choose the investment strategy for salary components above CHF 129 060 themselves. This gives them the ability to maximise the return on their pension assets while also optimising their tax burden.

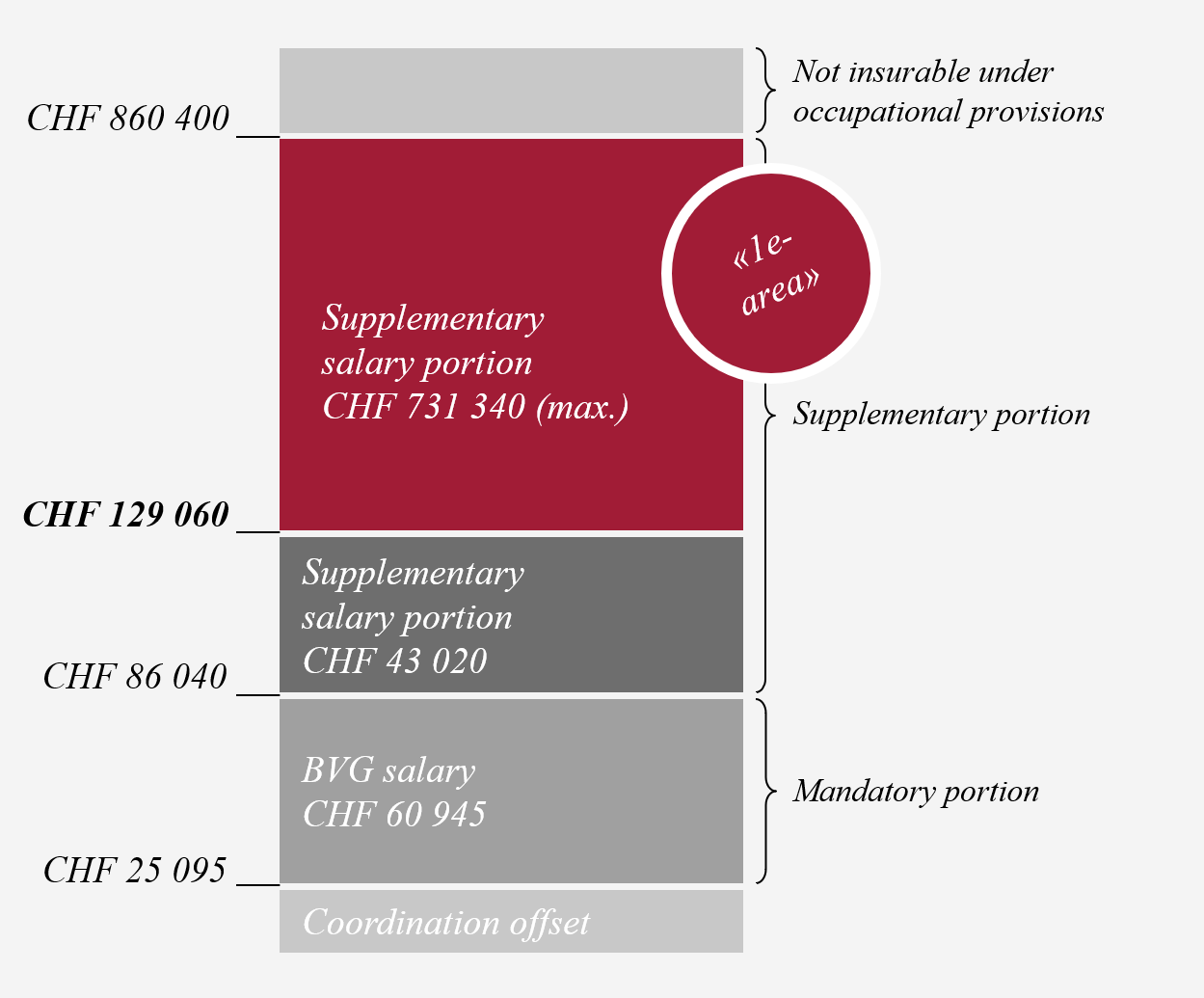

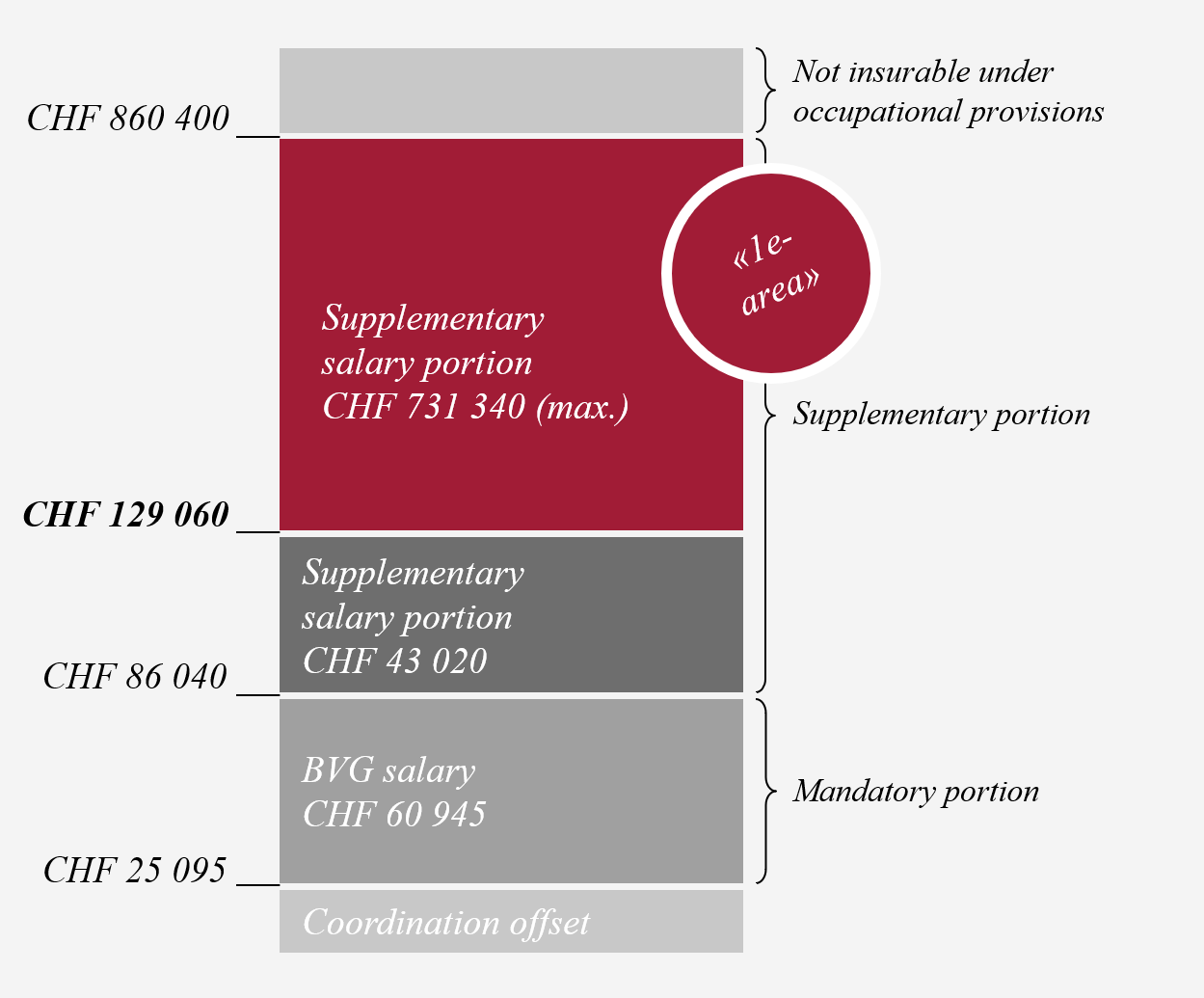

There is no flexibility with respect to the mandatory portion of occupational provisions. This mandatory portion encompasses salaries of between CHF 25 095 and CHF 86 040. In this respect, everything is clearly regulated by law: Salaries earn a minimum interest rate and are converted into a pension at a conversion rate of 6.8 percent. For pension assets of CHF 100 000, this conversion rate results in an annual pension of CHF 6800.

For salary components above CHF 86 040 pension funds are free to define the minimum interest rate and conversion rate themselves. The portion in excess of CHF 86 040 is referred to as supplementary. In general, insured persons have no say when it comes to the supplementary portion.

Greater self-determination with “1e solutions”

The situation is different when it comes to so-called “1e solutions”. With these supplementary insurance solutions salary components of CHF 129 060 or more can be insured and there is substantially more self determination. Specifically, the law allows for the individual selection of investments. The name “1e solution” comes from Article 1e of the Ordinance on Occupational Retirement, Survivors’ and Disability Pension Plans (BVV 2), which governs the choice of investment strategies. According to this article, insured persons can use a “1e solution” to decide for themselves which investment strategy they want to invest in. By law, employee benefits institutions may offer up to a maximum of ten investment strategies, whereby at least one of the strategies must be low-risk.

Take advantage of the flexibility and profit!

With “1e solutions”, you and your employees have the option of determining on an individual basis how their personal pension assets are invested. Each insured person can choose his or her preferred risk strategy – from low-risk to high-risk. This increases the flexibility of occupational provisions and provides individuals with the opportunity to realise higher investment returns. Swiss Life’s 1e plan offers a broad choice of investment strategies from the Swiss Life Investment Foundation, raging from bonds to 75% equity exposure. Insured persons are responsible for this portion of the pension assets themselves. They can profit from higher returns, but they will also have to bear any investment losses themselves. At Swiss Life, insured persons with a focus on security can opt for savings insurance and benefit from a nominal value and interest rate guarantee. As with other pension solutions, purchases in “1e solutions” can be deducted from taxable income. The tax burden can be further optimised, as the potential investment income does not need to be taxed annually – unlike private investment returns. A “1e solution” therefore offers the greatest possible individuality down to the employee level. Our experts are at your service and will be happy to help you analyse your personal pension and asset situation.

Companies that keep their books in accordance with IFRS can define all the pension benefits in capital form, which means they can remove the pension liabilities from their balance sheet, and thus reduce the pension obligations by the maximum amount possible.

The main points in brief

"1e solutions" are available to you and those of your employees with salary components in excess of CHF 129 060 (as of 2021). “1e solutions” allow employees to optimise the returns on their pension assets individually, enabling them to make investment decisions in a self-determined manner while taking account of their personal financial and risk situation. Purchases in “1e solutions” optimise the annual tax burden and potential investment returns do not have to be taxed each year.

Make an appointment for a consultation

The solution that is right for your company is very individual and depends on a range of factors. Our insurance advisors are happy to help you find the right solution for your company.

Article 19a Vested Benefits Act

Article 49a of the Vested Benefits Act (FZG) has been in force since 1 October 2017. According to the article, insured persons must bear any “1e” losses themselves.

Useful links

- To the Swiss Life Business Premium “1e solution” from Swiss Life incl. explanatory video (in German)

- Factsheet Swiss Life Business Premium

- Brochure Swiss Life Business Premium

- Media release: “Federal Council defines investment strategies that may be selected in second pillar and makes redemption easier” (in German)