With the 1e pension plan, employees can decide in a self-determined manner how part of their pension plan savings is invested and which investment strategy can optimise the return of their pension fund.

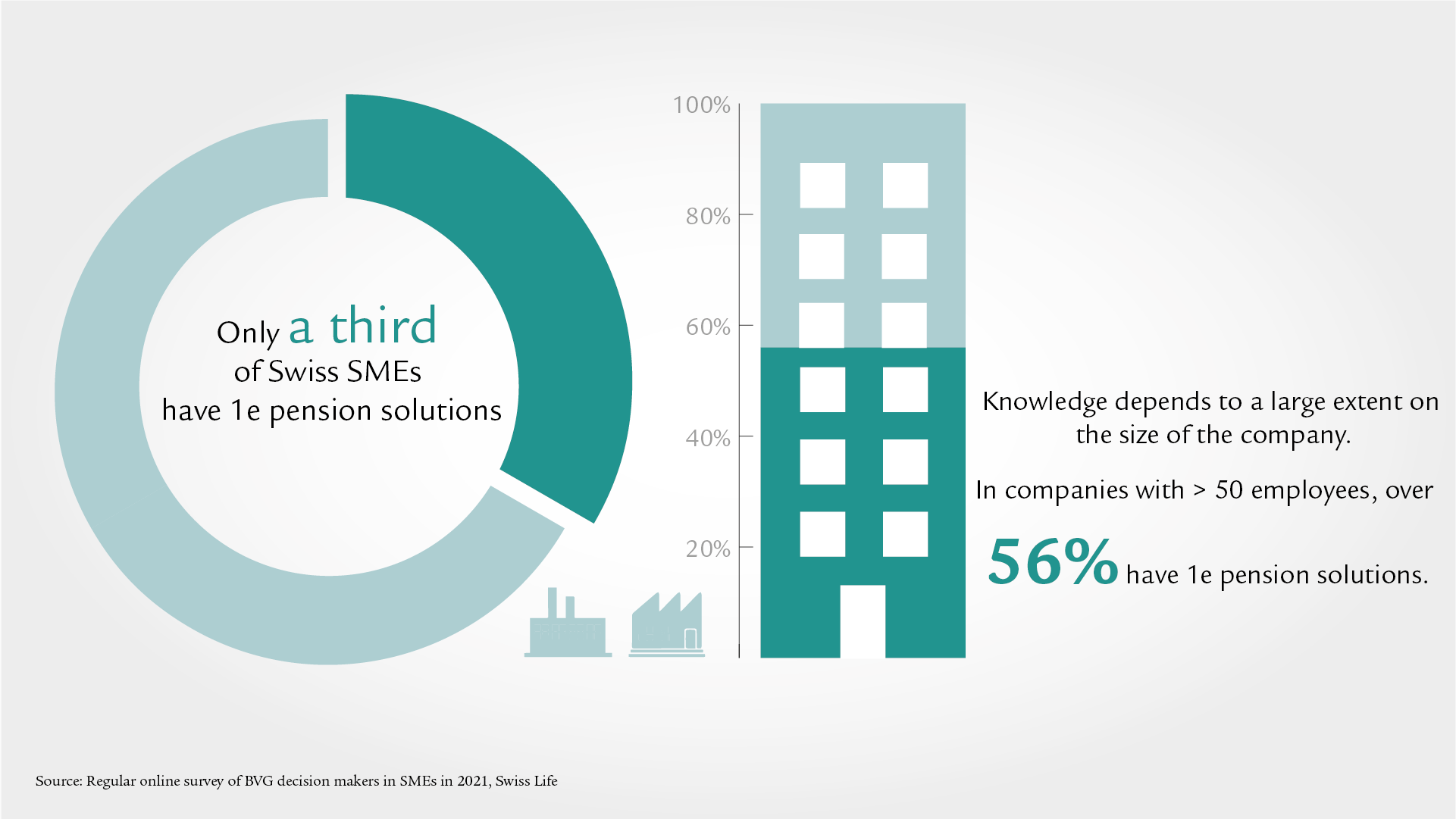

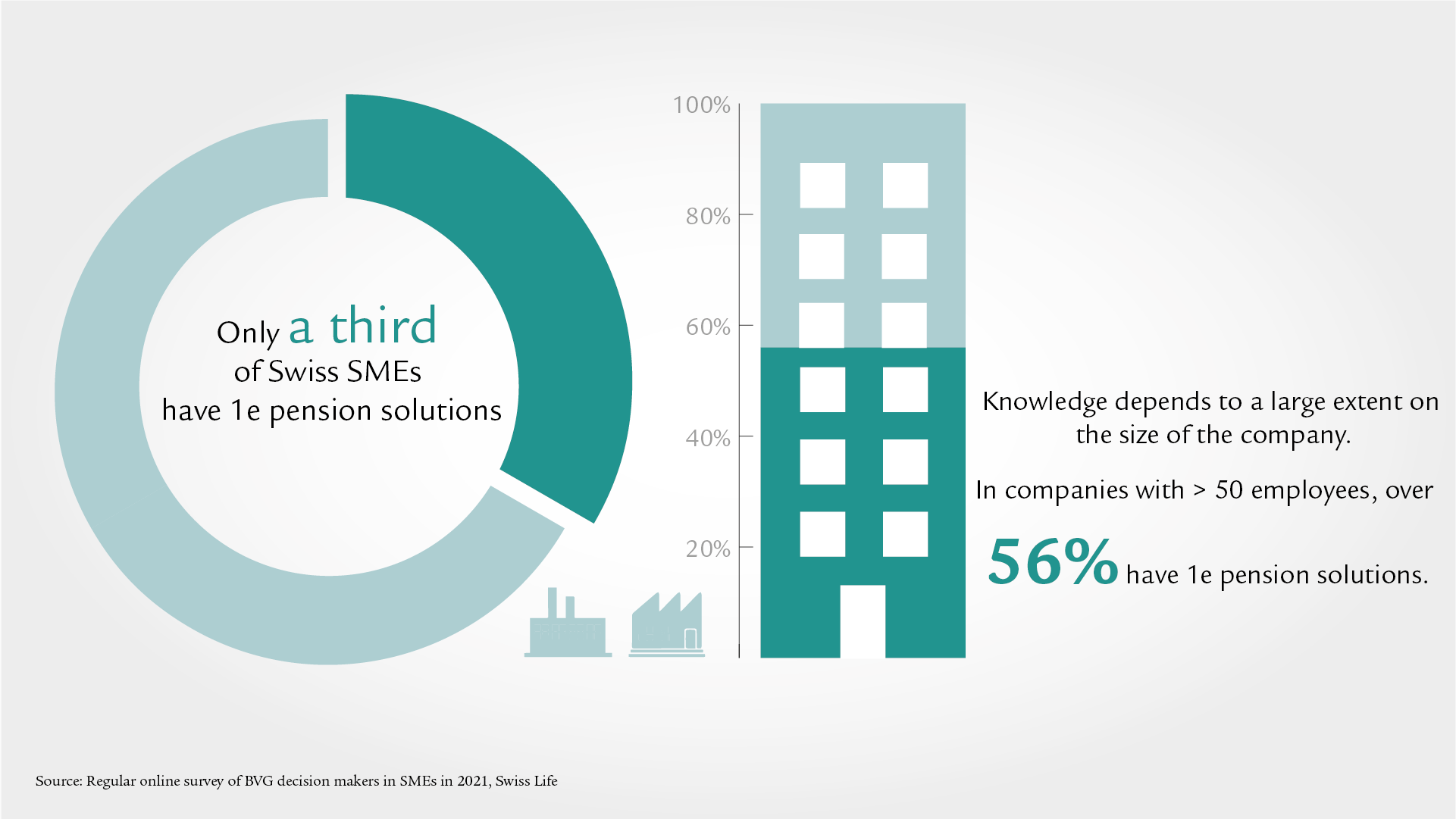

A Swiss Life survey of Swiss SMEs has found that only one in three employers has 1e pension plans. Knowledge depends to a large extent on the size of the company concerned. Small companies with fewer than 50 employees are less familiar with 1e pension plans than larger companies.

What is a 1e pension plan?

1e provisions are a modern and individual pension fund solution. Insured persons with a 1e plan enjoy the greatest possible flexibility and self-determination within their occupational provisions, as they determine themselves how their pension plan savings are invested. Insured persons select their investment strategy according to their personal investment horizon and risk capacity, thereby sustainably optimising the return on their pension assets.

Who can use the 1e pension plan?

The 1e pension plan is for insured persons who earn more than CHF 132 300 per year. For this reason it is also known as a management solution. The salary ceiling value of CHF 132 300 is one-and-a-half times the BVG ceiling.

What are the advantages of a 1e pension plan over a traditional pension fund?

Advantage for employees

- Selection option: Individual selection of investment strategy based on personal risk and investment horizon

- Transparency: Redistribution of investment income to other insured persons is ruled out. The investment result is credited to each individual insured person

- Security: For anyone looking for an all-round carefree solution – Swiss Life offers the option of savings insurance with 100% nominal value and interest rate guarantee.

- Tax optimisation: Contributions can be deducted from taxable income. It is also possible to make voluntary purchases to reduce taxable income.

- Additional savings: Insured persons benefit from improved retirement benefits through additional savings and higher returns• Investment expertise: Swiss Life is one of the three largest institutional asset managers in Switzerland with 165 years of investment experience.

- Advisory expertise: Swiss Life’s employees excel with their comprehensive expertise in pension provision and are able to present complex pension issues in a simple way.

Advantage for company or employer

- Do not bear any investment risks or restructuring risks

- No provisions for longevity risks, retirement benefits are often paid out as a lump sum

- Option of IAS/IFRS optimisation

- Since 2017, the 1e plan has been considered a contribution-oriented pension solution and therefore does not have to be booked as pension liabilities.

- This attractive pension solution with its flexible investment strategy and high potential returns can help employers retain qualified managers over the long term.

The Swiss Life 1e management solution

With the Swiss Life Business Premium 1e plan, insured persons can have a say in deciding about their pension fund. To invest their retirement savings they can choose from eight attractive investment strategies with equity components of up to 75%. Security-oriented employees can also conclude low-risk savings insurance with a 100% nominal value and interest guarantee.

Do you have any questions?

Make an appointment with our experts. We would be pleased to offer you a personal and non-binding consultation.

.jpg)