Unexpected events such as illness, accident or death soon lead to ma-jor financial costs. With the right risk insurance you can still finance your own home despite such misfortunes.

Minimising risks – securing your mortgage

Why you should secure your home financially

When you take out a mortgage, your financial situation is examined to check whether you have sufficient capital and income for your house or apartment. Important terms here are loan-to-value and viability.

The following rule of thumb also applies: the costs of mortgage interest, ancillary costs and repayments may not exceed a third of your gross income over the long term. You will then have enough money left for the rest of your living expenses.

If your income falls, thereby increasing your viability above the critical threshold of one third of your gross income, the mortgage provider may refuse to continue your mortgage. If you cannot find another provider, you will have to sell your house or apartment voluntarily in order to repay the mortgage. In the worst case scenario, the bank may use its power of sale to liquidate the property itself. That is why it is important to safeguard against this eventuality. Term life insurance, disability income insurance and long-term care insurance offer you comprehensive cover against any life risks.

Term life insurance

Why is term life insurance a good idea?

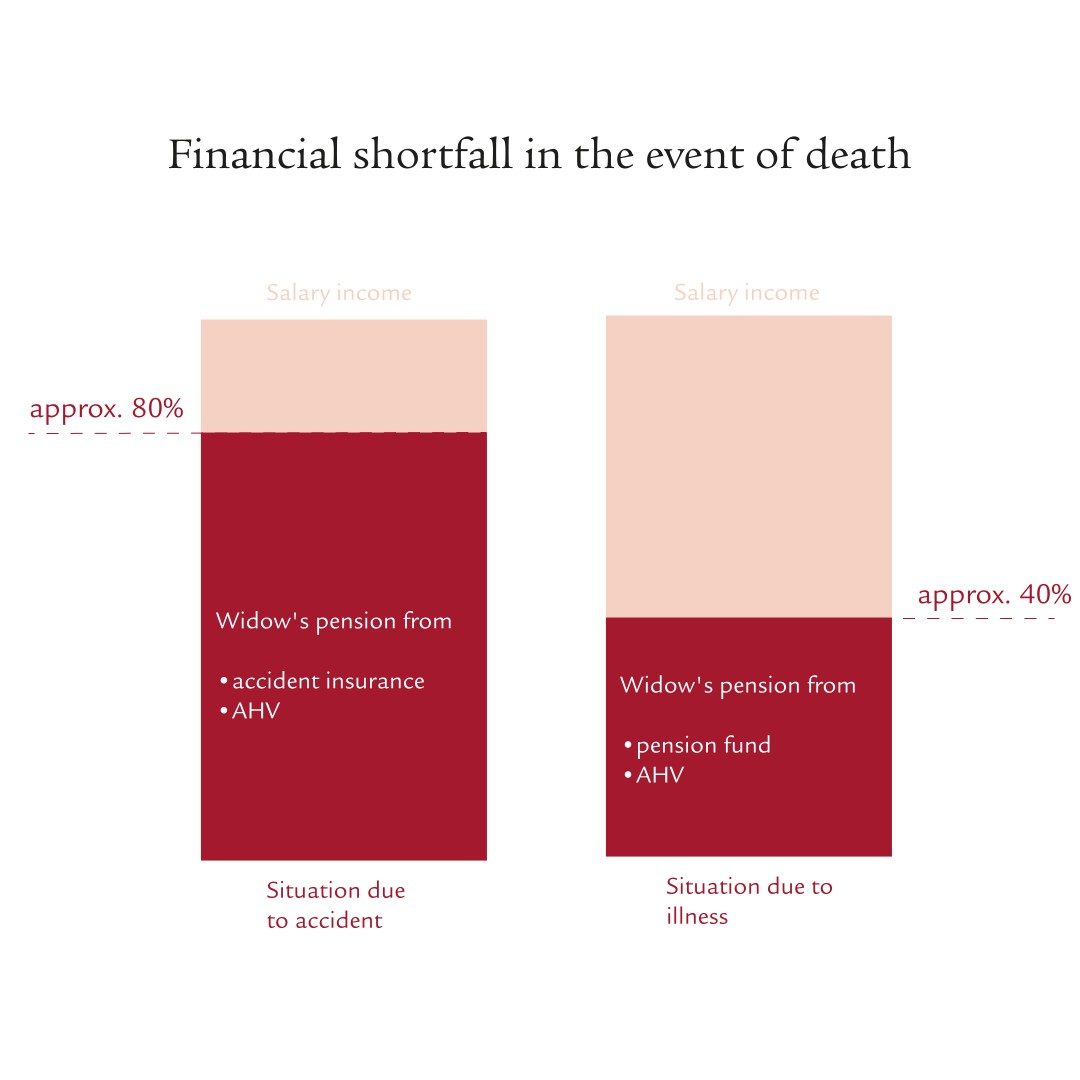

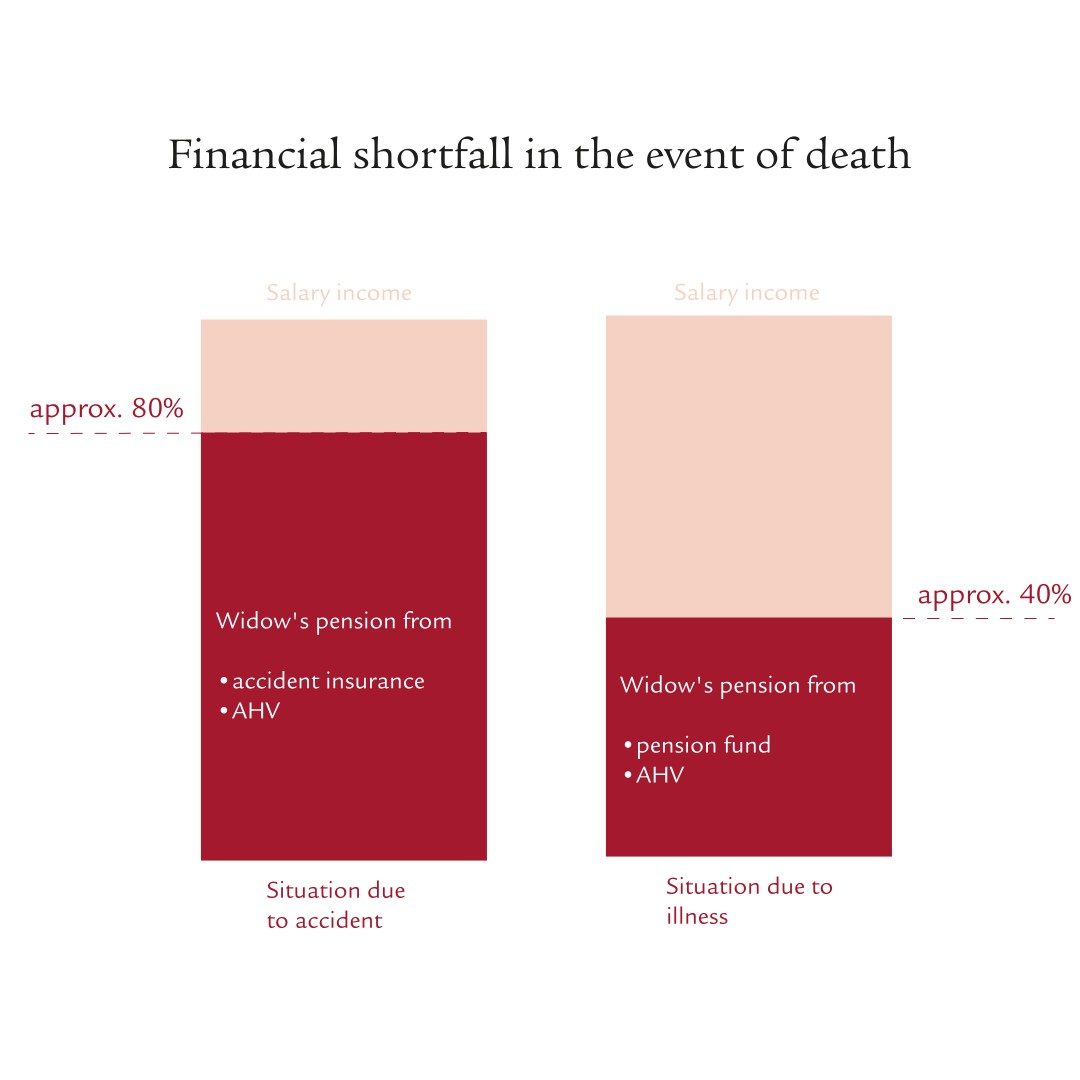

Death is a major emotional and financial burden for the surviving dependants. First and second pillar pensions are often insufficient to cover living expenses and ongoing obligations, such as a mortgage: OASI and pension fund benefits cover about 80% of the lost salary income following an accidental death. In the event of death as a result of illness, only around 40% of salary income is covered. This can result in a corresponding income gap. In the case of unmarried couples, the surviving partner is generally not entitled to a pension and dependent on a supplementary pension. With term life insurance, the family can continue to pay their running costs and stay in their own home.

Make an appointment for a consultation

Our experts at Swiss Life and Swiss Life Select would be happy to advise you at a location of your choice or online by video.

Disability income insurance

Why you should protect yourself against disability

Illnesses and accidents are unpredictable, but they can have drastic consequences for your earning capacity. In the worst case scenario, you may no longer be able to support yourself. You may be covered by your employer for some time. However, over the long term, statutory disability insurance will only cover a portion of your previous income. Risk insurance covers the gap of 10% in the event of an accident or 40% in the event of illness. That way you and your family can continue to pay the running costs of your home if you become disabled.

Long-term care insurance

Why is long-term care insurance worthwhile in the

event of disability?

There is always the risk of becoming dependent on long-term care as a result of illness, accident or age. However, the resulting costs are only partly covered by health insurance, your canton and your municipality. This can lead to significant financial burdens: an annual cost of around CHF 85 000 has been estimated for care in a nursing home. Your savings will then soon be used up and, depending on your viability, you may even have to sell your home. Long-term care insurance guarantees you a lifelong pension, which will allow you to remain financially independent even in this situation.